"In this world," wrote Benjamin Franklin, "nothing can be said to be certain except death and taxes."

As the April 18 tax filing deadline closes in, millions of Americans are frantically confronting that latter (but hopefully not former) inevitability.

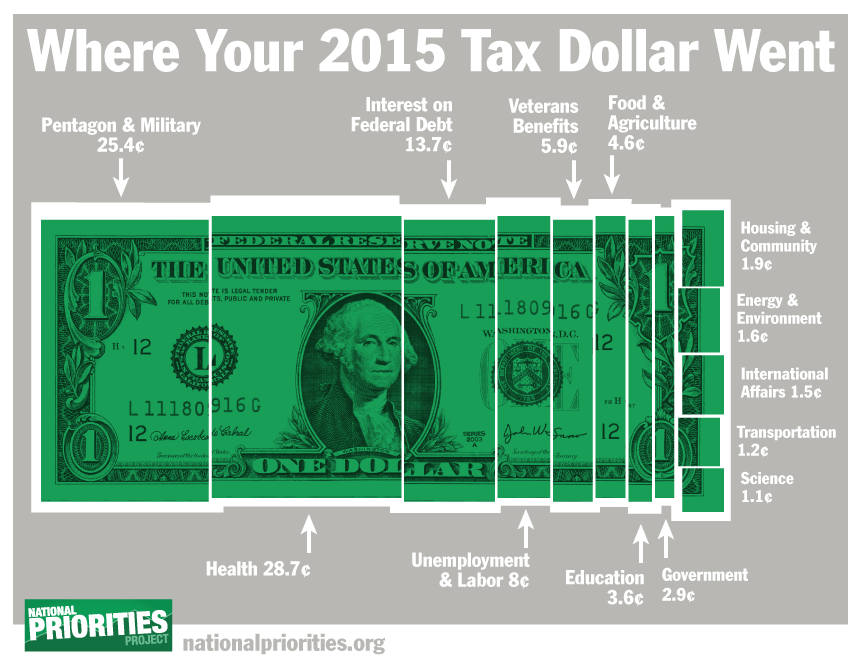

Let's be blunt: paying taxes isn't fun. After all, that's your hard-earned cash siphoned out of every paycheck. And for what, exactly? Where does it all go? And what do you get in return? It's not like the IRS gives you a detailed explanation of how your precious dollars are being spent.

Let's be blunt: paying taxes isn't fun. After all, that's your hard-earned cash siphoned out of every paycheck. And for what, exactly? Where does it all go? And what do you get in return? It's not like the IRS gives you a detailed explanation of how your precious dollars are being spent.

Fortunately, a bunch of neat web apps allow you to create a personalized tax receipt showing an itemized list of the federal programs and services your tax dollars are helping fund.

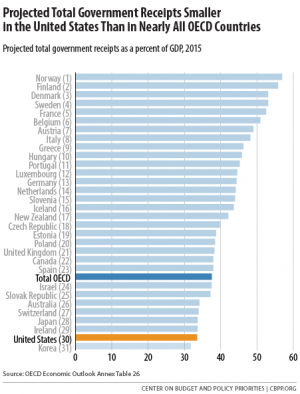

It's information that likely won't make paying taxes any less painful, but at least it'll shed a little light on what it is you're actually paying for. And, if it's any consolation, keep in mind that U.S. taxpayers on average pay significantly lower taxes than citizens in nearly every other wealthy nation in the world, according to the Center on Budget and Policy Priorities.

The Big Picture

Roughly 80 percent of all federal tax revenue comes directly from our paychecks, through income taxes and payroll taxes. In fiscal year 2014, the federal government spent $3.5 trillion (that's with 12 zeros), according to the CBPP. Of that, more than $3 trillion was financed by federal revenues (aka, our taxes). The remaining amount (about $485 billion) came from borrowing.