After President Trump slapped tariffs on aluminum and steel coming from the European Union, Canada and Mexico in May, Mexico responded with tariffs of its own on U.S-made cheese and a slew of other products in retaliation.

The United States-Mexico-Canada Agreement (USMCA), the successor to NAFTA, was agreed upon by the U.S., Canada and Mexico earlier this month. But it didn’t do anything to address Trump’s metals tariffs, and cheese remains a part of the United States’ trade war with Mexico.

Exports are an increasingly important way California’s cheese processors make money. And because Mexico represents a huge chunk of those exports, they’re feeling the pressure.

In 2016, almost a third of the state’s dairy products were exported to Mexico, according to data from the California Department of Food and Agriculture. Canada is a distant second, followed by China.

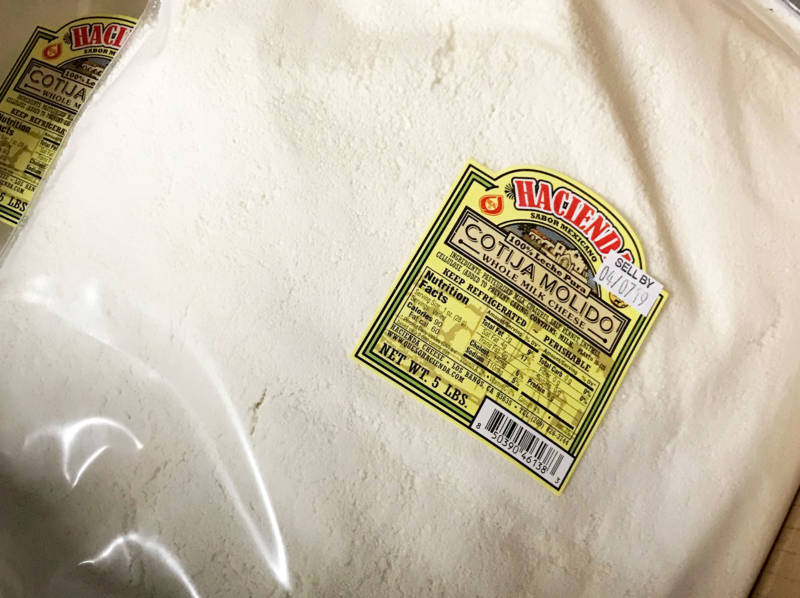

At the Peluso Cheese manufacturing facility in the Central Valley city of Los Banos, three women grind Cotija Molido into a crumble that’s used in traditional Mexican and Central American cooking.

The women stand as they work in a small refrigerated room cordoned off from the rest of the building with a plastic curtain. Before it leaves this part of the facility, the cheese will be bagged, labeled and boxed for shipping.

Cotija Molido is one of several cheeses — along with Oaxaca and Panela — that Peluso sells to consumers south of the border.