California has been dreaming of a clean, modern hydrogen highway since 2004, when former Gov. Arnold Schwarzenegger ordered preparations for a traffic jam of zero-emission, hydrogen-fueled cars, buses and trucks.

Proponents See Hope For California’s ‘Hydrogen Highway’ in 2020

That revolution, part of the battle against climate change, never materialized. The technology remains expensive and hasn’t gained wide traction, ceding the green-transportation crown to battery-powered electric vehicles, which are more widely available and support an ever-growing recharging network.

But with successful pilot projects using hydrogen buses and freight trucks, and car manufacturers preparing to expand model options in the tiny consumer car market, proponents say this may be the year when the “fuel of the future” finally arrives.

“Its moment is due. You are starting to see a sea change, as we get more aggressive about meeting our zero-carbon goals,” said Tyson Eckerle, deputy director of zero-emission infrastructure in the Governor’s Office of Business and Economic Development.

The state has continued to foster the promise of hydrogen fuel to pry carbon from transportation, California’s biggest source of planet-warming emissions. It has spent more than $300 million in the past 10 years funding rebates for those who buy or lease hydrogen cars, construction of refueling stations and the purchase of transit buses, as well as subsidizing development of hydrogen-driven freight trucks.

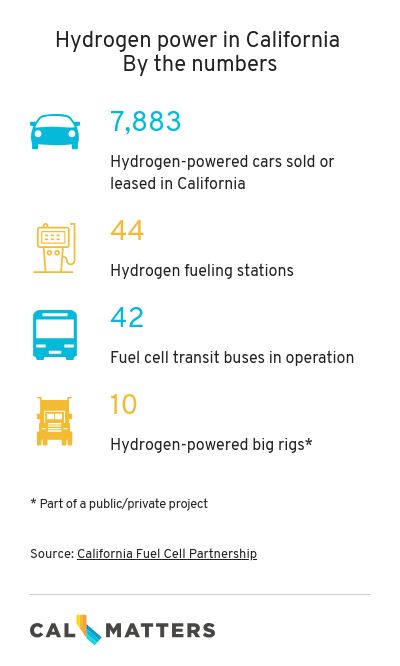

And, at the moment, California is the hydrogen market: All but a handful of the 7,800 hydrogen-powered cars in the U.S. are here. For car-centric Californians, there’s much to like: Hydrogen vehicles fuel up in a few minutes — as opposed to hours of charging for most electric vehicles — and their efficiency affords a long driving range.

Hydrogen as a transportation fuel has many applications. More than 26,000 hydrogen-powered forklifts are whirring around warehouses today, for example. The U.S. space program has long used hydrogen as rocket fuel. And more than a decade of testing hydrogen engines in transit bus fleets has produced results that surpassed projections, exceeding time without major repairs or replacement needed as compared to diesel engines. Hydrogen-fueled trucks are lighter, which translates into efficiency for long-haul drivers.

Eckerle said the dozen or so state programs encourage hydrogen technology to increase consumer choice — “seed-planting.” This investment will soon be eclipsed by that of private companies, he added.

The challenge for the automotive industry is overcoming basic market forces. There may be nearly 8,000 hydrogen cars on California roads, but that’s a microscopic number amid the state’s 35 million registered vehicles.

The cars are not easy to find, nor are the fueling stations: California has only 44 such stations, mainly in populous cities. It’s nearly impossible to fuel up a hydrogen car at home, so a broad network of stations is critical to wider adoption, experts say.

One reason motorists may not notice the hydrogen cars in their midst is that hydrogen-fueled Toyotas, Hondas and Hyundais don’t look much different from other sedans. That obscurity could end this summer, though, when hydrogen cars and shuttle buses built in Japan will be showcased at the Tokyo Olympics. Even the Olympic Torch will be lit with a hydrogen flame.

The international exposure, coupled with increased consumer education from manufacturers, could catapult hydrogen to front-of-mind for car buyers.

“We are at a really interesting point right now,” said Keith Malone, spokesman for the California Fuel Cell Partnership, which brings together state agencies, vehicle manufacturers and natural gas companies that make hydrogen fuel. “It’s no longer about proving the technology. It’s about bringing the technology to scale to drive down costs.”

Hydrogen fuel is much more efficient than gasoline, but it’s also four times more expensive, roughly equivalent to about $16 a gallon. Even though hydrogen cars, which run electric engines, have cruising ranges of more than 350 miles — longer than any battery-electric and some gas-fueled vehicles — the cost of a fillup is significant.

Incentives have eased that financial hit somewhat. Manufacturers offer refueling cards loaded with three years’ worth of credit, and the state offers a $4,500 clean-car rebate. That rebate mostly offsets the first year of leasing a hydrogen vehicle, which most drivers choose over purchasing. New hydrogen cars are in the $60,000 range, and lack the variety of model options available for battery-powered electric cars.

Aaron Slavin and his wife, who live in the Los Angeles suburb of Altadena, made a spreadsheet to weigh the pros and cons of driving a hydrogen-fueled car and concluded that continuing to own a gas-electric hybrid “didn’t pencil out.”

“I’m a big fan of this car; I preach about them,” Aaron Slavin said, while refueling his 2017 Toyota Mirai at a one-bay hydrogen pump tucked into a conventional gas station in South Pasadena.

Slavin, a performing-arts producer, said he is a perfect candidate for the car — self employed, with no regular commute, and with a hybrid SUV as backup.

The second car became critical last year when an explosion at fuel-production facility choked supplies for months, leaving some hydrogen stations with empty tanks, stranding some drivers or necessitating long trips to alternative stations. The crisis, which some drivers dubbed the “hydropocalypse,” sent Slavin to a smartphone app that provided a real-time inventory of fuel at each station.

That fuel hiccup has been resolved, but it raised a red flag. “Our lease is up in April, and I really have to give some thought to what we’ll do,” Slavin said. “I like the car, but I’m concerned about the fuel situation.”

Producing energy from hydrogen has long been an enticing goal. After all, hydrogen is the world’s most abundant element, it’s energy-dense yet lightweight and, when used in transportation, emits not greenhouse gases but tiny pools of water.

But there’s a carbon backstory to this clean-burning fuel. Even though after it is formulated it powers zero-emission electric motors, about 95% of hydrogen fuel is made with an energy-intensive process that relies on methane, the worst of the planet-warming gases. That makes it difficult for some environmental groups to support hydrogen vehicles.

“We need to get methane out of the system, not establish a dependence on producing more,” said Kathryn Phillips, Director of the Sierra Club in California. “If you look at hydrogen fuel cells through an environmental lens, right now it’s not the best use of state funds.”

Proponents respond in two ways: While the state transitions to a zero-carbon economy, why not capture and use methane that today is spewing, unchecked, into the atmosphere from oil and gas facilities and landfills? Why not switch to a process that doesn’t require methane and instead uses the state’s surplus of solar power to do it, rendering the manufacturing clean and green?

Even with the advantages of faster refueling, lighter weight and longer range than battery electrics or gasoline cars, hydrogen vehicles can’t compete in a critical category: price. A conventional city bus may carry a price tag of $450,000. A hydrogen bus with the same specifications runs closer to $1 million.

To Lewis Fulton, a transportation researcher at UC Davis, hydrogen presents “several different chicken-egg problems at the same time.”

Until more cars are produced and purchased, he said, there won’t be more hydrogen fueling stations. And until there are enough fueling stations, consumers may worry they’ll be stranded and won’t feel comfortable driving the cars.

“The only way to solve it is a really massive policy push,” Fulton said. “There’s already a fairly big one going on in the state, but I don’t know if it’s big enough.”

California’s efforts to encourage the hydrogen car market could be thwarted as part of its ongoing battle with the Trump administration, which last year withdrew the state’s authority to set its own tailpipe emissions standards. Car makers who sided with the feds in favor of lower emissions rules will pay a price by being excluded from the state’s vehicle fleet.

Toyota, which took Washington’s side, would be left out at a time when the company is ramping up its hydrogen program and, by dint of its status as a major international car maker, is expected to significantly raise consumer awareness about hydrogen vehicles.

Proponents downplayed the issue. Eckerle admitted, “It is an elephant in the room.” But he added that the state has no indication from car makers that they intend to back away from their commitment to making hydrogen vehicles.

“It’s a bump in the road,” he said.

CalMatters.org is a nonprofit, nonpartisan media venture explaining California policies and politics.