In case you've been hiding out in a cave this week (one without a dependable wireless connection, that is), you've probably heard that Twitter has gone public.

The microblogging platform that took the world by storm less than eight years ago, now has more than 100 million daily active users worldwide and is valued at close to $13 billion. In September, the company filed for its Initial Public Offering (IPO). And on Thursday, amid much fanfare, Twitter's stock began trading on the New York Stock Exchange under the ticker symbol TWTR, with shares initially priced at $26 a pop.

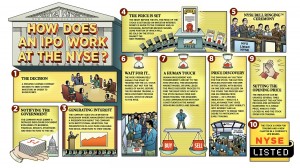

Ok, so what does all this mean? To help demystify the IPO process, the NYSE made this nifty little cartoon, at right. Click on it to view full-size version. If questions still arise, see the text explainer below.

What’s the difference between public and private companies (and how do IPOs fit into that)?

The vast majority of fledgling companies need start-up funds, and that generally comes in the form of investments and loans. Private companies rely, not surprisingly, on private investments. Most of that usually comes bank loans or from businesses called venture capital firms that invest in companies and make money on their returns if the companies end up doing well (or, conversely, lose out if the company flops).

A private company may decide to go public if it wants more investment capital to expand its business. To do so, it files for an IPO – an Initial Public Offering. The company is essentially divided equally into tiny little units (stocks) and each unit is given a monetary value based on how much the company is estimated to be worth upon filing.. Outside investors are then allowed to purchase various quantities of shares through the stock market. Whoever buys any portion of stock in the company becomes a stockholder, meaning that individual investors stand to make money if the company does well, or lose money if it doesn't.