All that's left to do now is sign the darn thing.

The Republican-controlled House of Representatives gave final approval Wednesday (for the second time) to a $1.5 trillion tax cut, the biggest overhaul of the U.S. tax code in 30 years.

Party leaders rushed the hastily drafted bill through Congress in a matter of weeks in a largely secretive process that included no public hearings. It now heads to the White House for President Trump to sign into law, allowing him to triumphantly fulfill a long-standing campaign promise and claim his first legislative victory since taking office nearly a year ago.

In a nutshell, the legislation:

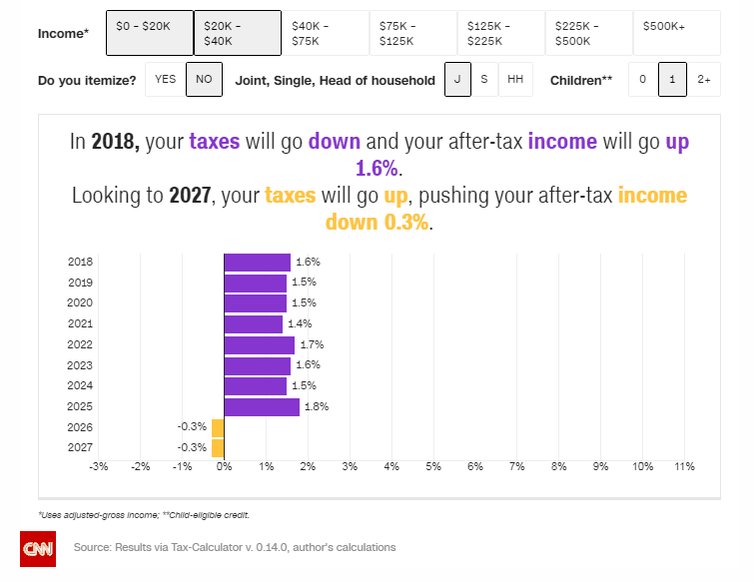

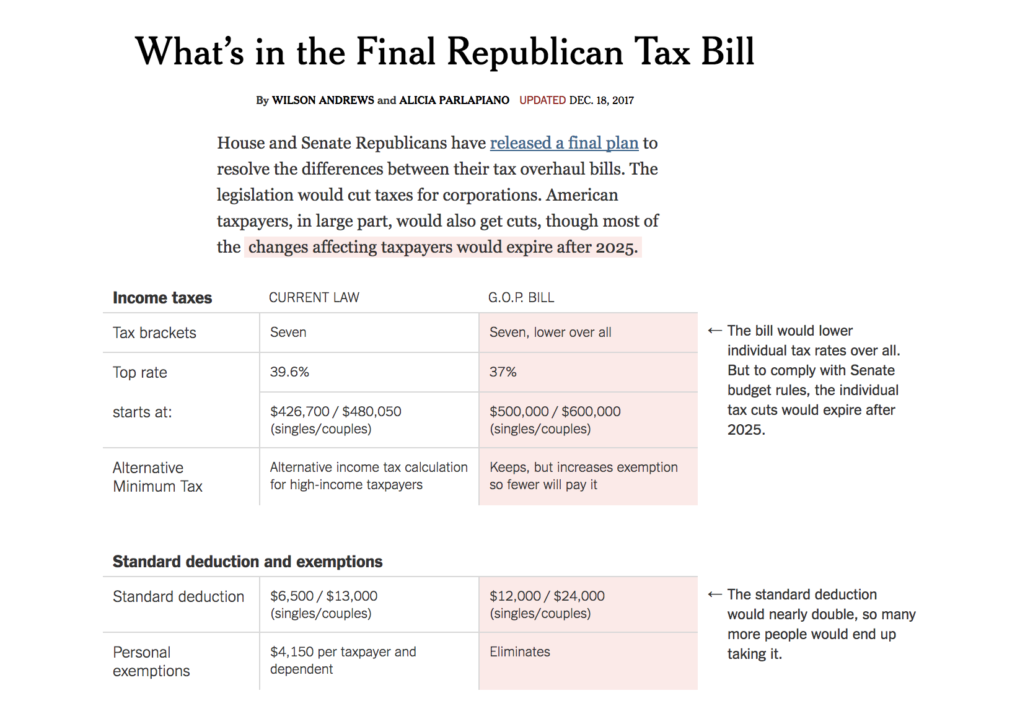

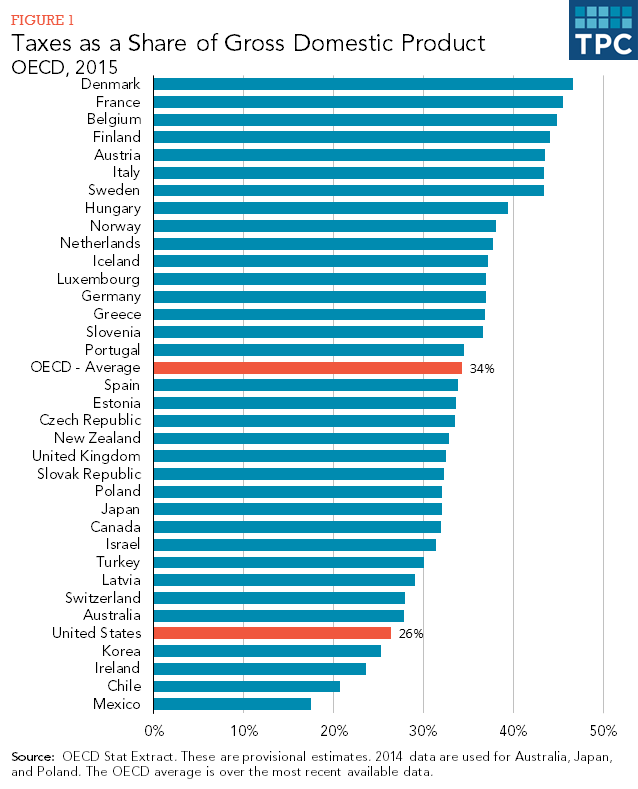

- Permanently slashes the tax rate for corporations from 35 percent to 21 percent. It also includes moderate tax cuts for some individuals and families, but those cuts are only temporary; they expire in 2026, and taxes for many lower- and middle-class Americans will actually go up after that.

- Will add more than $1 trillion (that's with 12 zeros) to the federal deficit over the next 10 years, according to a preliminary estimate by the nonpartisan congressional Joint Committee on Taxation.

- Nearly doubles the standard deduction — from $6,350 to $12,000 for single filers and $12,700 to $24,000 for married couples filing jointly — encouraging many more people to take it.

- Imposes a new $10,000 cap on deductions for state and local income taxes and property and sales taxes (currently, it’s unlimited), a change expected to be particularly detrimental to millions of residents of high-tax states like California, New York and New Jersey. Companies, though, will still be able to deduct state and local taxes as normal business expenses.

- Repeals the individual mandate in the “Obamacare” health care law, which currently requires all Americans to buy health insurance or pay a tax penalty (this doesn't go into effect until 2019).

- Doubles the current $1,000 per-child tax credit.

- And oddly ... opens up Alaska’s Arctic National Wildlife Refuge to oil and gas drilling.

Passed without the support of a single Democrat, the bitterly divisive tax plan underscores the two parties' diametrically opposed visions on how best to grow America's economy and serve its people. Trump and other Republican champions of the legislation insist that the massive cuts will pay for themselves, a test of their long-held conviction that slashing taxes for corporations and the wealthy stimulates economic growth and creates lots of new jobs and higher wages. It's a theory that has been repeatedly disproved by recent historical experience: The large tax cuts pushed through by President Ronald Reagan in 1981 and President George W. Bush in 2001 and 2003 all led to temporary economic boosts that quickly petered out, resulting in extended slowdowns and rising deficits.