D

o you know how much your neighbor’s house cost? How about how much they pay in property taxes? We usually don’t pry into our neighbors’ lives and ask these questions, but as part of our special on California’s Proposition 13, that’s exactly what we did.

This year marks the 40th anniversary of Proposition 13, which essentially locks in a homeowner’s property tax to the year they bought their home — no matter how much their home increases in value.

To get a sense of Proposition 13’s impact on Californians, KQED Education Reporter Vanessa Rancaño looked at her own neighborhood in North Oakland, where she rents a home.

On a rainy day in late November, three of her neighbors and a fellow Oakland resident met in Rancaño’s living room for brunch and a conversation about how Proposition 13 affects each of them differently — even though they live just doors away from each other.

Michelle Krasowski works as the Librarian Specialist in support of Adult Services for the Contra Costa County Library System. She has rented an apartment on the block for two years, and says she spends most of her paycheck on rent. She says she was shocked when she found out how her rent compares to what her landlord is paying in property taxes.

“I feel like he’s he’s getting a lot out of this and I’m getting a lot sucked out of me and my life. I’m here to serve the public and my community, I’m invested in improving people’s quality of life — especially for people like me who are government workers. I can’t negotiate a higher salary. I have a salary cap. There is no rent cap, there is no home sales cap. So in this particular climate I’ll never be able to own a home. And that’s really sad to me as somebody who really cares about the people around me.”

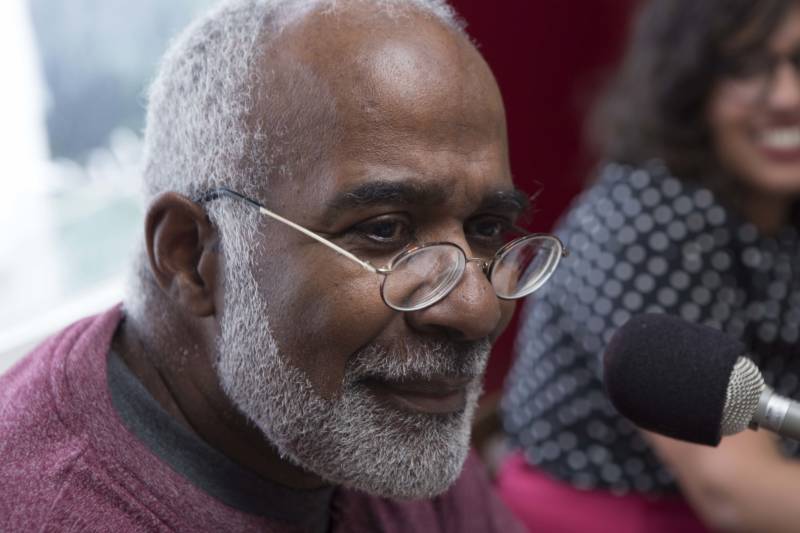

Ken Wilkins

In 1976 (two years before Proposition 13 passed), Ken Wilkins bought his home for $18,500. That was $2,000 less than he paid for the car he drives now. Now, he pays only $1,800 in property taxes, which helps him stay in the neighborhood as a retired senior.

“I think I [voted for Proposition 13], but I really didn’t think it out really well. I think there should have been some other compromise like businesses should not have had that break at all. But I actually am happy to be under Proposition 13. [If Proposition 13 were theoretically repealed], I think I would move to Nebraska!”