Today there are more than 700,000 Bay Area residents with student loans who collectively owe nearly $27 billion, an amount that’s more than tripled in the last 15 years ago.

New Report Traces Dramatic Rise in Student Loan Debt in the Bay Area

That’s according to a new report from the Federal Reserve Bank of San Francisco and the city’s Office of Financial Empowerment, which tracks the dramatic growth of student loan debt and default in the Bay Area since 2003. The percentage of people in the Bay Area borrowing to finance higher education has nearly doubled since then, and the default rate has more than doubled, the analysis finds, a trend that’s hit lower-income African American and Hispanic communities particularly hard.

Student loan debt “fuels economic, gender, and racial inequality, inhibits asset accumulation, accelerates wealth gaps, and carves out a generational divide that, even in the best of circumstances, will take decades to erase,” the report states.

“In many ways, student debt is like kerosene on a fire, accelerating the disparities raging across our communities,” said Seth Frotman, executive director of the Student Borrower Protection Center, a nonprofit advocacy organization. “The student debt crisis is landing at the door of cities, and this report is the proof.”

African American and Hispanic borrowers take on more debt and then struggle to pay it back, noted Frotman, who formerly served as a lead regulator overseeing student loan markets at the federal Consumer Financial Protection Bureau.

“That has large implications across their financial lives,” he added. “Access to credit, to buy a house or a car. Student loans, which were meant as an avenue supposedly to chase the American dream, are actually leaving these communities further and further behind.”

Despite the dramatic increase in student borrowing in the Bay Area, the rate here, of 12.2%, is actually lower than the average rate in California (13.9%), and significantly less than in the rest of the country (17.9%), according to the report. But, it’s authors note, “our research finds that Bay Area and even county-level trends mask dramatic disparities among communities throughout the region.”

Student borrowing has spiked nationwide in large part because more people are attending college and tuition at many institutions, particularly state schools, has risen exponentially.

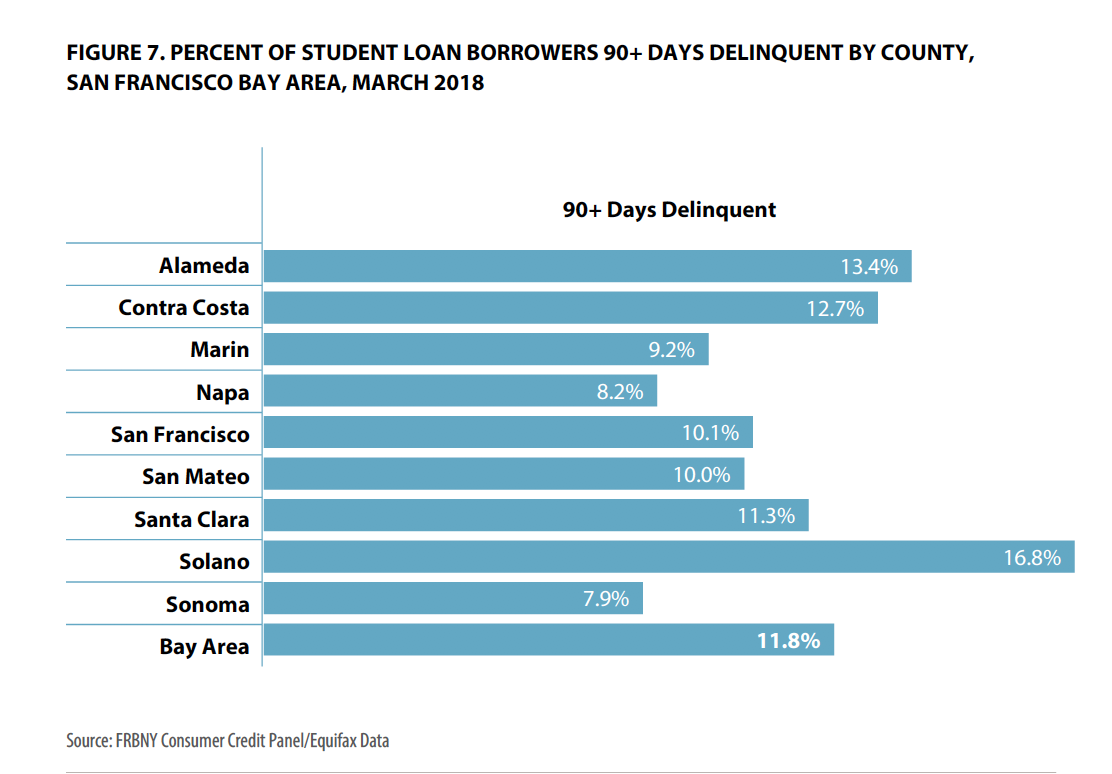

The research breaks down student debt by ZIP code and finds some of the heaviest levels of borrowing in San Francisco, Marin and San Mateo counties. But when it comes to delinquency — when payments are late or overdue — rates are significantly higher in low-income communities of color.

One of the most striking examples of this, according to the report, is in Solano County, where the student loan delinquency rate is nearly 17 percent, the highest among the Bay Area’s nine counties, despite it having the lowest level of educational attainment.

Top 10 Bay Area ZIP codes with the highest percentages of student loan borrowers who are 90+ days delinquent (March 2018)

Source: FRBNY Consumer Credit Panel/Equifax Data; American Community Survey (via Student Debt in Bay Area report)

“So the people who are really worse off are ones who go to some school, go for a couple of years and it just doesn’t work out. Life happens,” Frotman said. “And now they have no comparable wage growth but are stuck with this debt. And those are borrowers where you see significant default rates.”

He added, “The sheer increase in the amount of borrowers struggling in these counties is astronomical.”

The report also highlights East Oakland’s Coliseum neighborhood, where nearly one-third of borrowers are at least 90 days past due on their student loan payments. Defaults there are generally highest among borrowers with less than $9,000 in debt.

“When students default, it hurts their credit and slows down their ability to get ahead, buy a home,” Frotman said. “But beyond that, we are now seeing the impact of this collective debt on communities.”