State Senate President Pro Tem Toni Atkins, D-San Diego, praised Newsom's priorities and pledged that lawmakers will "deliver a final budget that will make a real difference for Californians, while maintaining the safeguards we need to protect the state’s economic health.”

But Republican lawmakers — who represent a small minority in the Democratically-controlled Legislature — criticized the governor for proposing any new taxes while the state has a surplus.

State Sen. Patricia Bates, R-Laguna Niguel, singled out the governor's proposed tax on water bills to help pay to clean up polluted drinking water in disadvantaged communities. The tax would cost most Californians about 95 cents a month; large agricultural customers would pay $10 a month.

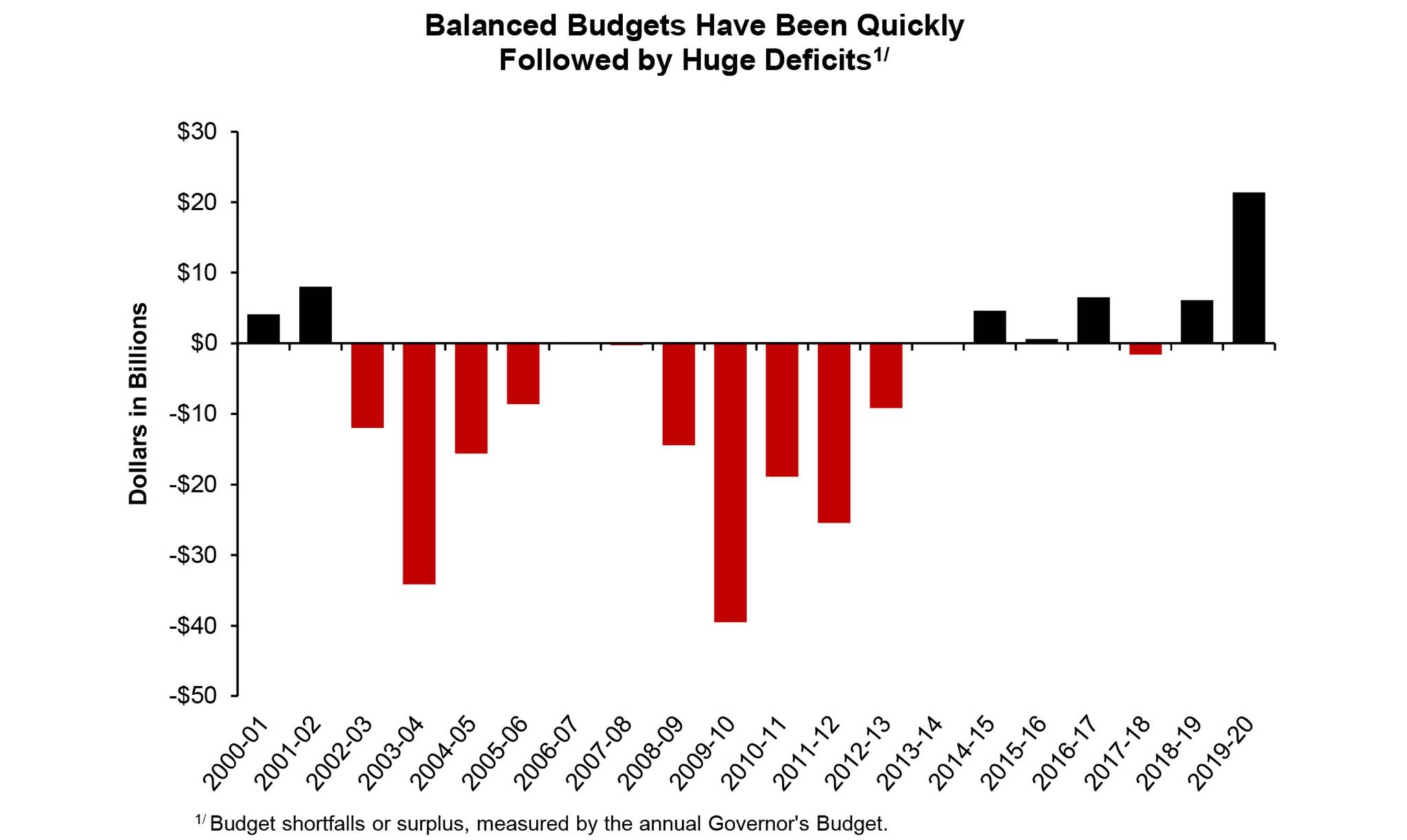

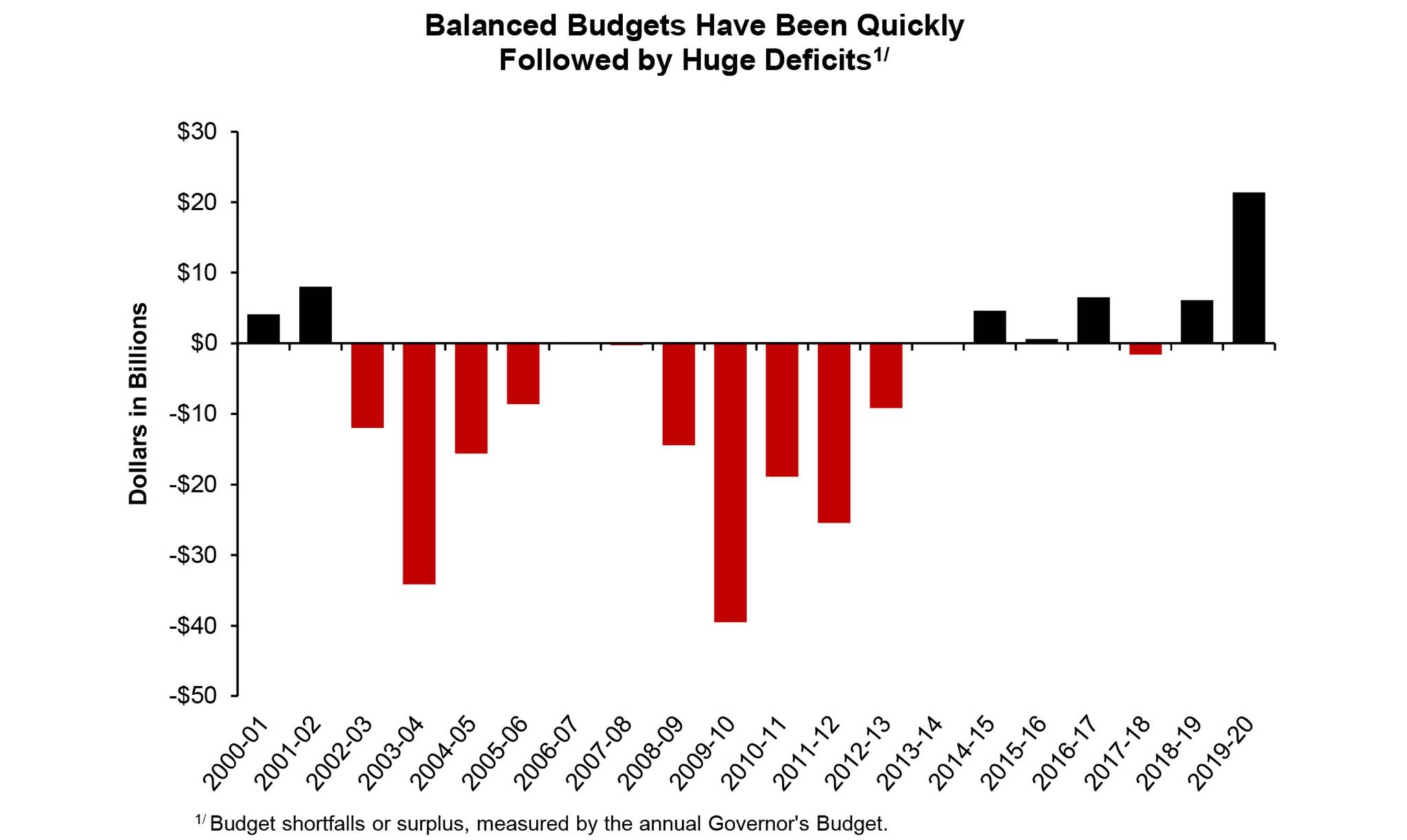

“The governor’s desire for new taxes despite an estimated $21.5 billion budget surplus is unfortunate, unhelpful and unnecessary," Bates said. But she praised his plans to help low-income families, build the state’s rainy day fund and modernize schools.

On K-12 funding, the governor noted that 45% of this budget is going into education, above the level required by Proposition 98, a 1980s ballot measure that mandates a baseline on school spending.

"Prop. 98 is often a ceiling, but this budget is $4.4 billion above the Prop. 98 requirement," Newsom said, noting that the plan includes a reserve fund for education specifically.

After hearing from mayors and other local officials, Newsom is also proposing an additional $150 million for local governments to combat homelessness, raising the total to $650 million. That's part of a total of $1 billion in spending to fight homelessness.

The governor called homelessness "a stain on the state of California," adding that residents are "outraged and disgusted by it" and wondering what Sacramento is going about it.

He also acknowledged that his original goal for new housing construction is meeting resistance, adding that "we can't step back from our resolve and commitment" to building more housing. Despite pushback from both Republicans and Democrats in the Legislature, Newsom is not backing away from a plan to tie road funding for local governments to their willingness to meet state housing goals.

Newsom's ambitious spending plan is the result of a booming California economy.

But the governor, channeling his predecessor, Gov. Jerry Brown, also warned of a coming recession.

Newsom projected any downturn would be "more modest than (the one in) 2007 but a little more intense than the 2001 recession," with a downward impact of $70 billion on state revenues over three years. He said he hopes to see another year of growth so the state can grow its reserves even more, saying that another big infusion of cash into the state's savings accounts would leave California in a much better place to weather a future recession.

In the meantime, one of Newsom's top priorities is making California more affordable for everyone, particularly working families. On Tuesday, ahead of the review, he announced plans to end the sales taxes on diapers and feminine hygiene products — a long-held goal of the Legislative Women's Caucus — and add two weeks to California's paid family leave policy.

The sales tax exemptions would sunset after two years, but Newsom said he hopes the state will be able to keep the exemptions in place long term.

In 2016, Gov. Brown vetoed legislation to eliminate taxes on diapers and tampons, saying in his veto message that "tax breaks are the same as new spending" and should be handled in the regular budget process, as Newsom is now proposing.

But the new governor's embrace of this tax cut and other ideas to help struggling families further highlights not just his differing priorities, but the fact that unlike Brown, Newsom has children — including two who still use diapers.

Assemblywoman Lorena Gonzalez, D-San Diego, who has long championed tax relief on diapers, said the move was overdue.

"This tax relief will go a long way in helping those young families who we know are at their most economically vulnerable," she said. "In California, more than 50 percent of the children born are on Medi-Cal. We know that young parents struggle. We know that diapers are a necessity not only for the health of the child, they're also required in order to drop your child off at child care. If you want a job, you have to have diapers."

The changes Newsom is proposing, he noted, will help both low- and middle-income families. But he's also suggesting investments in programs aimed at the working poor, such as two extra weeks of paid parental leave.

Read the 2019-20 May Budget Revision below.