Under the current rules written back then, a reassessment is only triggered when a person or legal entity acquires more than 50% of the ownership interest. Companies have used that loophole to avoid property tax increases, by selling no more that 49% to any one person or entity.

As a result, companies like Disneyland, Intel and Chevron are currently paying taxes based on property assessments from the 1970s.

Willie Brown says now that the legislature blew it back then.

“We should have said anytime there is a change in the ownership of the property through any means, that constitutes a transfer for reassessment purposes,” Brown said recently.

“The legislature can do that. And that’s where it ought to be done,” said Brown, who opposes Prop. 15 and has received consulting fees from the “No on 15” campaign.

Whether the legislature “blew it” when it wrote the Prop. 13 implementation rules for commercial property or did it intentionally to please business interests is hard to know. One thing’s for sure: It’s much easier for lobbyists to influence legislation than ballot measures.

In fact, the Legislature tried to revise the law to close the loophole and to reassess commercial property more often. In 2010, Assembly Bill 2492, authored by former Assemblyman Tom Ammiano, would have defined a “change of ownership” as happening whether or not any one legal entity or person that is a party to the transaction acquires more than 50% of the ownership interests. The bill died in committee.

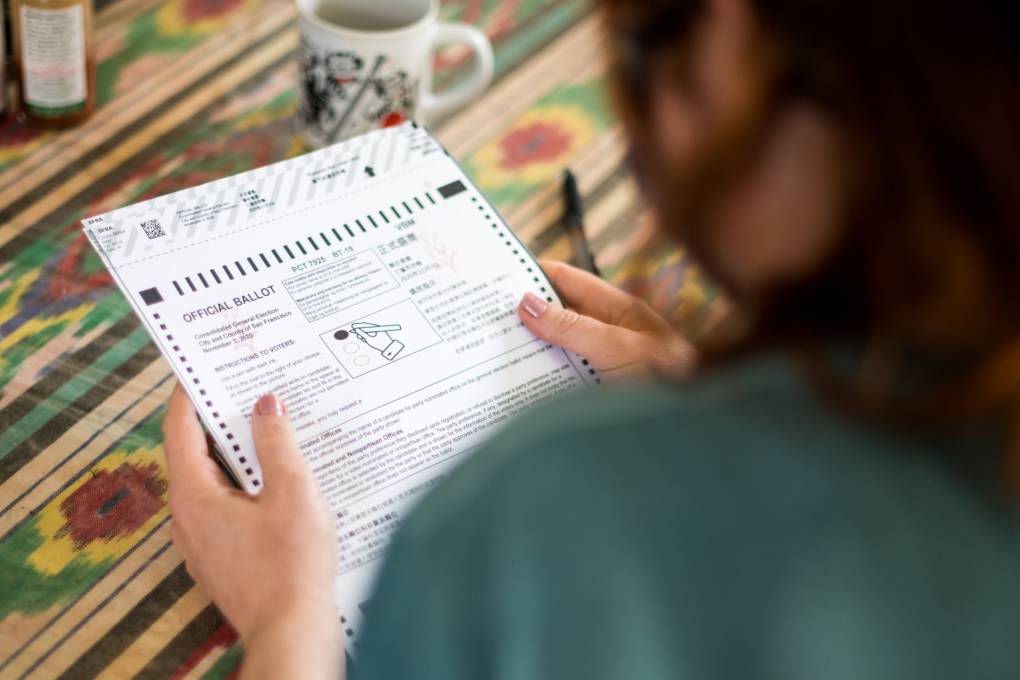

Prop. 15 would require that commercial and industrial properties be reassessed on a regular basis, with property taxes based on current market value, rather than what the property cost when it was purchased. According to the nonpartisan Legislative Analyst, the measure would send $6.5 to $11.5 billion in new revenue annually to schools and local governments.

Residential and agricultural property along with commercial property worth less than $3 million would be exempted from the change.

Prop. 13 passed at a time when California was a much different place than it is today — more white, more conservative and less diverse. Manuel Pastor, director of University of Southern California’s Program for Environmental and Regional Equity, says that over the years, the measure has worked to exacerbate the wealth gap.

“You’ve got a system right now that is inequitable in terms of where the burden of the property taxes are more on residential folks and more on the most recent buyers who tend not to be the wealthiest, tend to be more people of color,” Pastor said.

He says the fate of this year’s Prop. 15 could indicate how much California has changed.

“The question is, are we the California that passed Prop. 13? Or are we the California that wants to reevaluate that and think about investments in young people?” Pastor asked.