Makras’s next court date is scheduled for Dec. 16, the same day Kelly is set to appear.

During the hearing, U.S. Magistrate Judge Jacqueline Scott Corley

also placed travel restrictions on Makras, who must now obtain permission to leave the region.

Original post, Oct. 20: Harlan Kelly, a former general manager of San Francisco’s Public Utilities Commission already accused of accepting bribes from a city contractor, pleaded not guilty Wednesday to new bank fraud charges leveled against him by federal prosecutors.

Kelly was charged Tuesday with two new counts — bank fraud and conspiracy to commit bank fraud — alongside local real estate investor and former city commissioner Victor Makras.

According to the indictment, Kelly and Makras defrauded Quicken Loans by inflating the amount of money Kelly owed on his mortgage — to qualify for a lower-interest refinance loan. The complaint also alleges that Kelly and Makras lied to the lender about debt owed by Kelly.

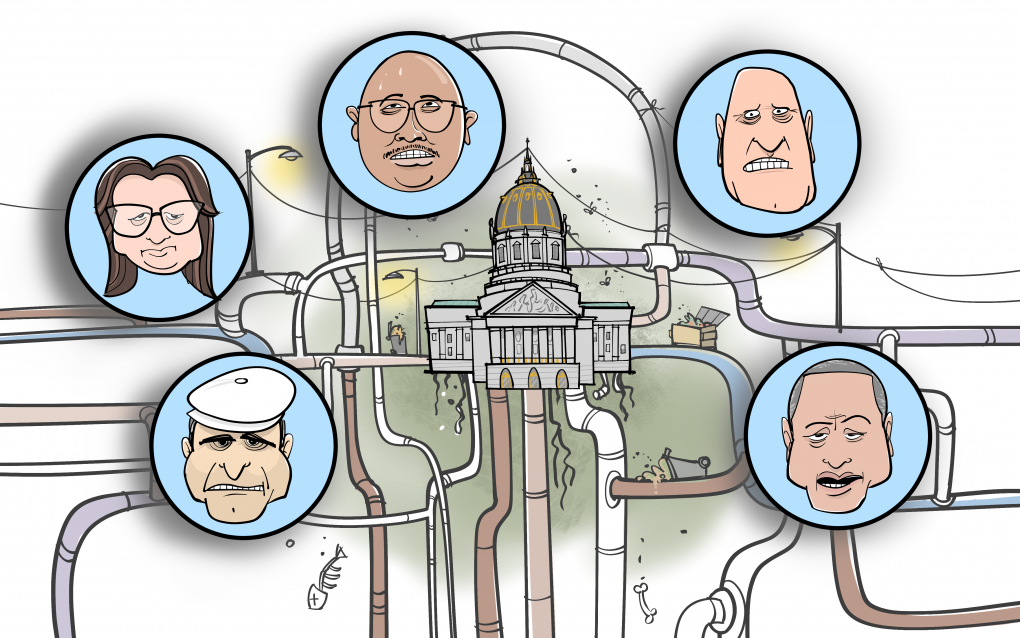

The indictments are part of a wide-ranging public corruption investigation that has led to charges against 12 people and the resignation or ousting of four city department heads, including Kelly and Kelly’s wife, former City Administrator Naomi Kelly. Naomi Kelly has not been charged with any crimes.

First charged last year was Mohammed Nuru, the longtime director of San Francisco Public Works.

Nuru was arrested in January 2020. Federal prosecutors have accused him of taking more than $1 million in bribes from people doing business with the city, and of attempting, unsuccessfully, to bribe a San Francisco airport commissioner.

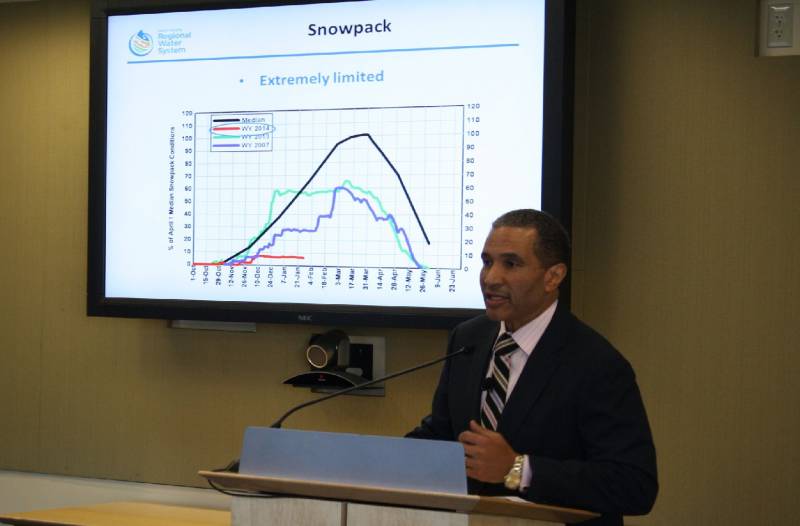

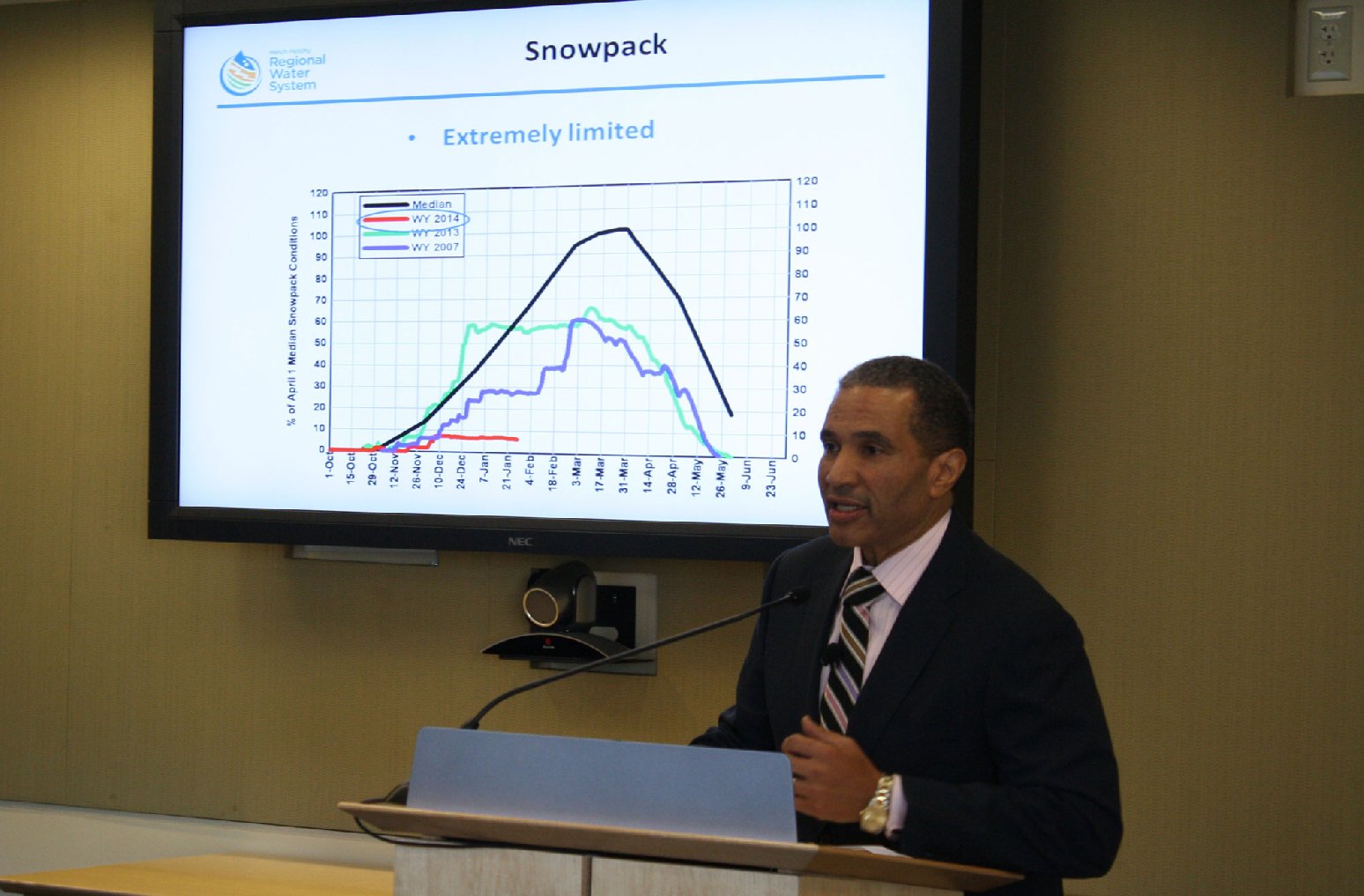

Kelly was arrested in November 2020 and stepped down from his role as head of the city’s PUC. The U.S. attorney’s office charged him with five counts related to an alleged bribery scheme, saying he accepted thousands of dollars in international trips, meals and other gifts from city contractor Walter Wong, in exchange for providing Wong with information meant to help him win a multimillion-dollar contract from the SFPUC for a citywide LED lighting contract. Wong’s son was bidding on the contract.

Wong, who is cooperating with federal investigators, is identified only as “Contractor #1” in court documents. In a statement this week, the U.S. attorney’s office wrote that the indictment against Kelly alleges “that Kelly provided confidential internal PUC documents and information to Contractor #1 to give Contractor #1 competitive advantages during public contract bidding competitions.”