California is losing its middle-income earners, often referred to as “middle class,” according to new research released Thursday by California Community Builders, a nonprofit housing research and advocacy organization.

California's Middle Class Declines as Low and High Incomes Surge, Study Shows

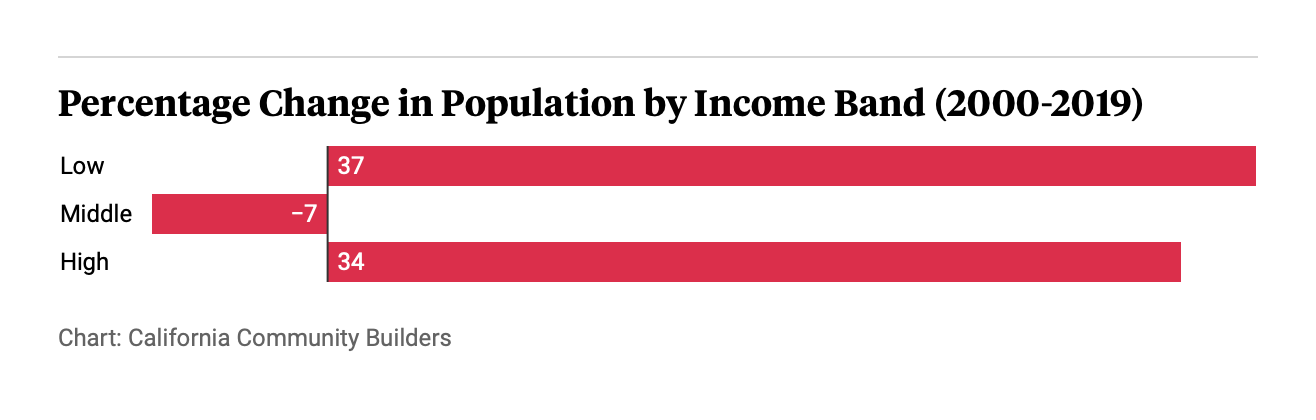

The researchers found that the state lost 7% of residents in this demographic between 2000 and 2019. They defined middle income as those making between 80% and 200% of the area median income, which varies depending on location. For a family of four, that can range from $137,100 to $362,600 in high-priced Santa Clara County to between $65,950 to $167,600 in more rural and agricultural areas of the state, such as Humboldt and Fresno counties.

“That’s a huge amount of people when you consider the size of California,” said Adam Briones, CEO of California Community Builders. “Just the fact that our state is becoming both a state for the very poor and for the very rich is something that we believe should be shocking to policymakers and really needs a lot more attention.”

It’s also an incredibly diverse group of residents, Briones said. Sixty percent of middle-income earners are people of color, according to the report.

“We really, really want to get away from the narrative that all people of color are low income,” Briones said. “That’s really just not the case.”

The trend is even more pronounced among families that are considered lower middle income, with that population seeing a 35% drop in population. That includes families earning between 80% and 120% of area median income.

The report didn’t look at why people were leaving, but other studies have pointed to high housing costs as one main driver for middle-income residents, and especially lower-middle-income residents, to leave the state.

Eric McGhee, at the Public Policy Institute of California, said his organization’s research into the trend also found it was especially pronounced among lower- and middle-income residents. The researchers used a different definition of middle income, capping it at $137,500 for a family of four.

“We do see over time that as the cost of housing increases in California relative to the rest of the country, we do see people moving out at higher rates,” he said.

That’s been true since at least 2010, McGhee said, but he said the trend has become more pronounced in the past 10 years.

During the pandemic, higher-income residents were leaving the state at a higher rate than in the past, according to McGhee and other researchers at the Public Policy Institute of California. The rise in remote work precipitated that trend, he said, but it has recently slowed.

“We’re also seeing that particular part of it dial back,” he said.

When it comes to policy recommendations for retaining lower- and middle-income residents, Briones said more research is needed. His organization helped shape a down-payment assistance program, California Dream For All, that rolled out last year. It provided loans for up to 20% of the down payment on homes for residents who made up to 150% of the area median income that is repaid when the homeowner sells the house, along with 20% of the home’s appreciation.

That program had so much demand its funding was exhausted within 11 days of its launch. A second round of funding is scheduled to roll out in April.

California Community Builders is also sponsoring a bill, Assembly Bill 2140, that would direct the state to study the creation of a large-scale homeownership financing program for middle-income residents. Briones emphasized the intent of the legislation is not to propose any programs that would be funded at the expense of supporting low-income residents.

“We truly don’t think that those two groups are at odds,” Briones said, adding the policy question the legislation hopes to consider is, “How do we create more resources for affordable homeownership that does not reduce resources for affordable rental housing?”