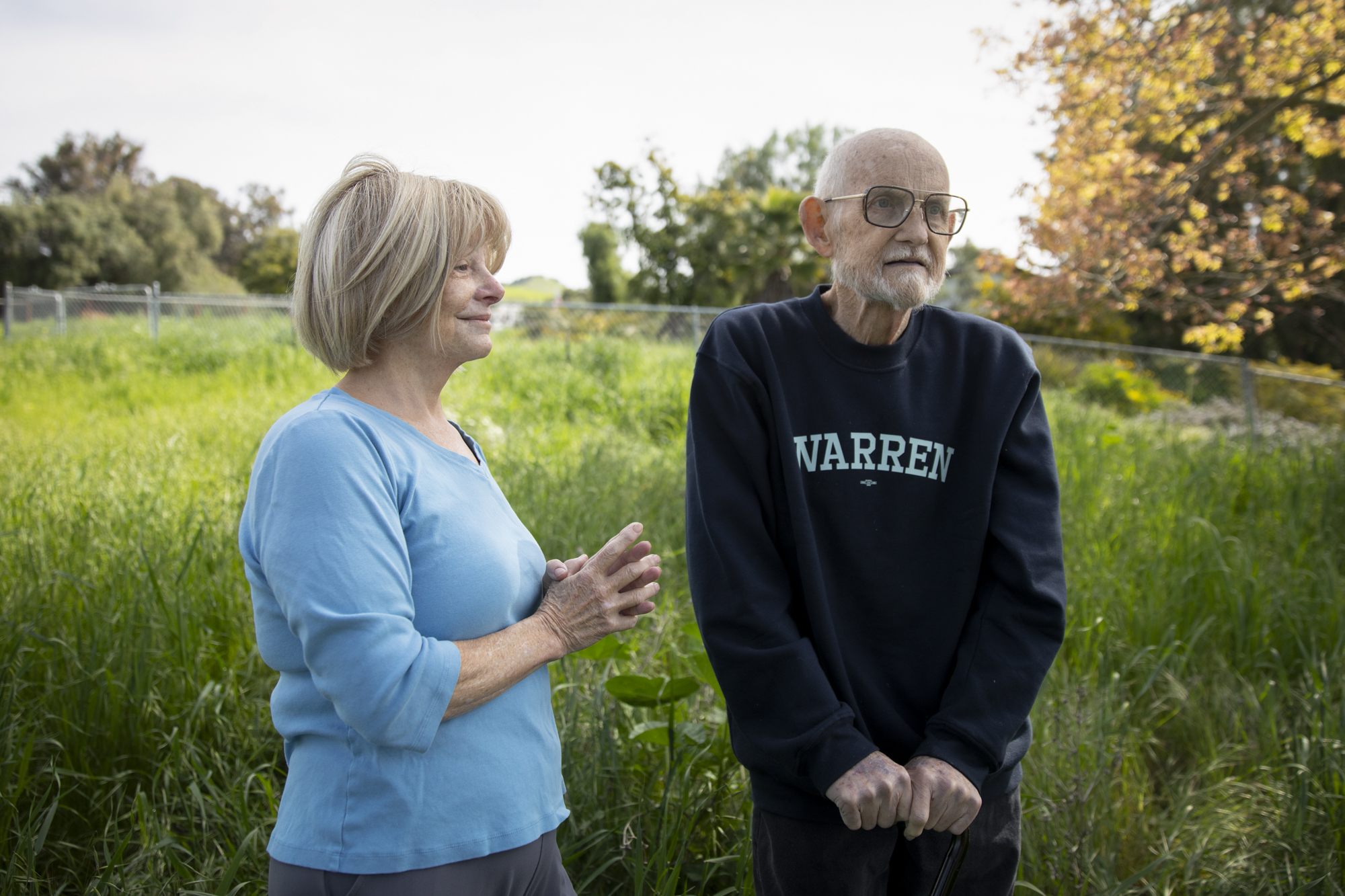

Brian and Gail Tremaine moved to East San José 45 years ago for the quiet. On the outskirts of this Silicon Valley city, atop what was once an apricot orchard, the couple kept sheep, goats and horses.

They planted mulberry trees along the driveway and carved terraces and patios out of the sloping hillside, but a portion of the 1.7-acre property remained untamed.

“It’s just become an area where we need to do weed control and keep it clean because the county gets after us if the weeds get too high,” said Brian Tremaine, 75. “We’re getting to the age where we want less land.”

The couple first considered building an accessory dwelling unit (ADU) or backyard cottage. But the cost — with estimates ranging from $500,000 to $700,000 — was formidable, Brian Tremaine said, as was the idea of taking out a second mortgage.

That’s when they learned about BuildCasa — a company that would purchase a portion of their backyard and assist them in splitting the lot under SB 9, a controversial law that went into effect in January 2022. It allows property owners to build up to two duplexes on most single-family properties.

At the time of its passage, supporters hailed it as the end of single-family zoning in California and an opportunity to spur more housing, while critics worried it would spark a dramatic shift in the makeup of California’s suburban neighborhoods. But in the first two years since the law was in effect, it has produced little in the way of either new lots or housing.

A KQED survey of 16 cities of varying sizes across the state found that between 2022 and 2023, the cities collectively approved 75 lot split applications and 112 applications for new units under the law. That’s compared to more than 8,800 ADUs the cities permitted during the same time frame.

However, a growing cadre of companies is hoping to jumpstart the construction of SB 9 projects by taking on the permitting and development work themselves, as well as making it easier for homeowners to take advantage of the law.

“These types of projects are really costly and complicated for a homeowner to take on,” said Ben Bear, co-founder and CEO of BuildCasa. “They’re basically asking the homeowner to be a developer, which, from a financial and capabilities perspective, is a challenge.”

In Southern California, Yardsworth has emerged with a model similar to BuildCasa. But unlike the latter company, which sells the lots to developers, Yardsworth plans to develop the lots themselves and either sell or rent out the new homes. Elsewhere in the state, other companies are specializing in particular aspects of SB 9.