Nearly 3.7 million students and 667,000 newborns in California have money invested in a savings account to help pay for college. But most families don’t know the money is there.

Citlali Lopez, a second-year psychology student at Sacramento State, found out a few months ago she had $500 sitting in a California Kids Investment and Development Savings Program (CalKIDS) account. Although she’s been eligible to use the funds since she graduated high school in 2022, she had no idea until her sister, who works at a nonprofit that supports lower-income students with scholarships and financial aid, told her to check her eligibility. Lopez was skeptical at first, but found she was eligible and registered her account.

“I was just really surprised that I was able to get some extra help,” she said.

Financial aid had been top of mind for her and guided her decision to go to Sacramento State. She plans on using the money to finish general education classes over the summer if financial aid will not cover it.

So who gets money? Under CalKIDS, all babies born in California receive a sum. Babies born between July 1, 2022 and June 30, 2023 received $25 deposits, and all babies born after July 1, 2023 receive $100 deposits.

As part of the program, all first grade students with low-income receive a onetime deposit of $500. First graders who are in foster care receive an extra $500 and homeless first graders receive $500 more, totaling $1500 for some students. All the accounts are tax-free, and the money is invested whether or not families claim their accounts.

Additionally, the state spent $1.8 billion in the 2021–22 budget to provide a onetime deposit to all lower-income students in grades 1 through 12 in 2022.

Yet, of the 4.3 million student accounts created, only 313,445 accounts have been claimed by families, meaning they have registered online and seen the amount in their accounts. Only 6.3% of newborn accounts have been claimed and 7.4% of student accounts have been claimed as of March 2024.

The state is slowly building awareness about college savings

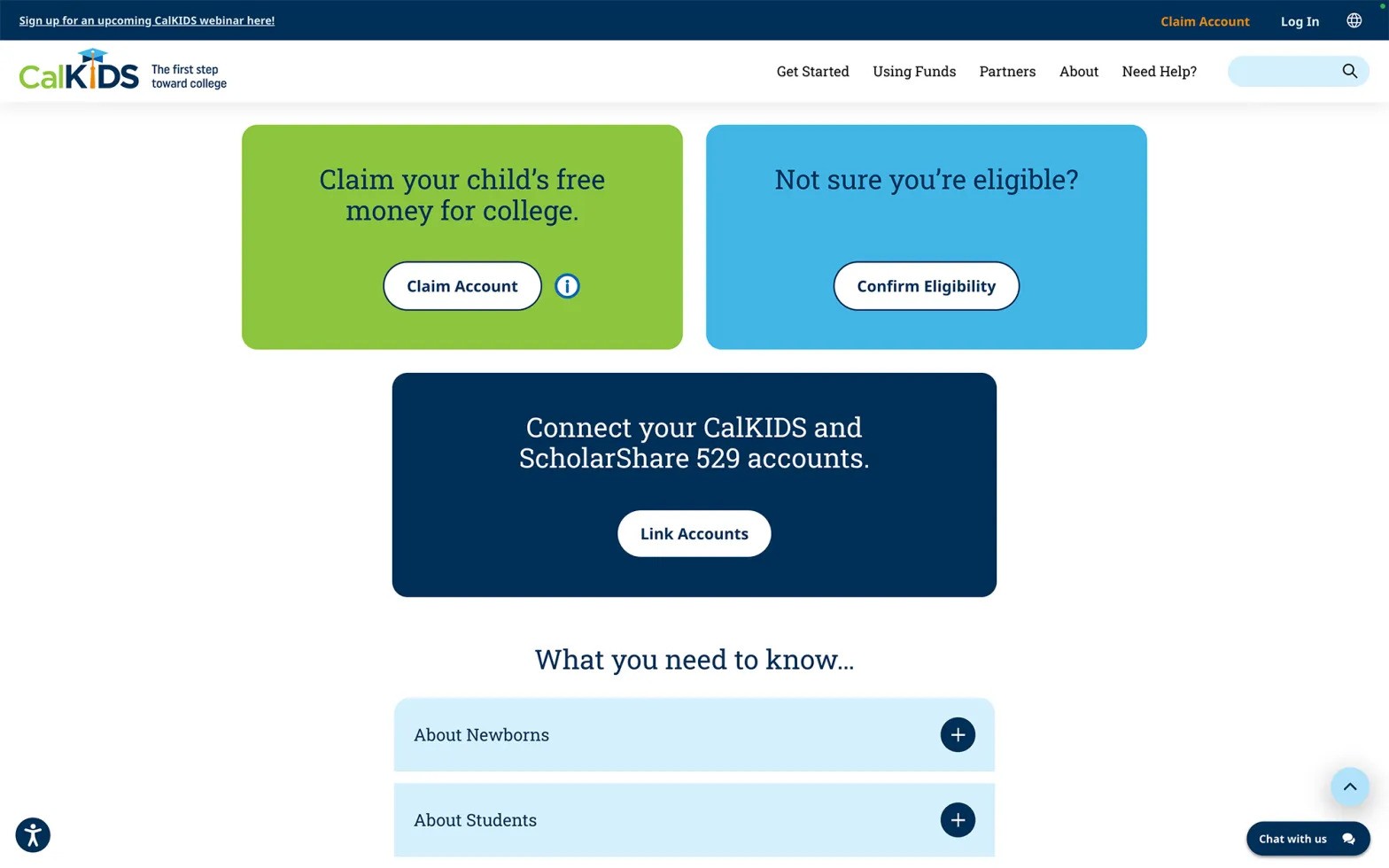

CalKIDS is run by a three-person team led by Julio Martinez, the executive director of the Scholarshare Investment Board, an agency within the State Treasurer’s Office. It administers the state’s 529 college savings accounts, which allow families to invest money tax free to cover education related expenses in the future. The team is responsible for creating the accounts, notifying families about the accounts and explaining what CalKIDS can provide to families.

“With these programs, it takes time to kind of build brand awareness, and also to break down the skepticism that often exists when you get a letter in the mail that says you have free money,” Martinez said. CalKIDS staffers go to college fairs and financial aid nights and host online informational sessions to reach families and students.

The state allocated $22 million (PDF) in the 2022 and 2023 budgets to market the program. In Los Angeles, Riverside, Fresno, and Sonoma counties, CalKIDS program info is sent to all families that request a birth certificate, according to Joe DeAnda, the director of communication at the State Treasurer’s Office. During the first three months of this year, registration in the newborn program has more than doubled, from 20,608 to 42,312 newborns.