Updated March 12, 2025

It’s FAFSA — the Free Application for Federal Student Aid — season again. And for some applicants, the memories of last year’s troubled rollout may still be fresh.

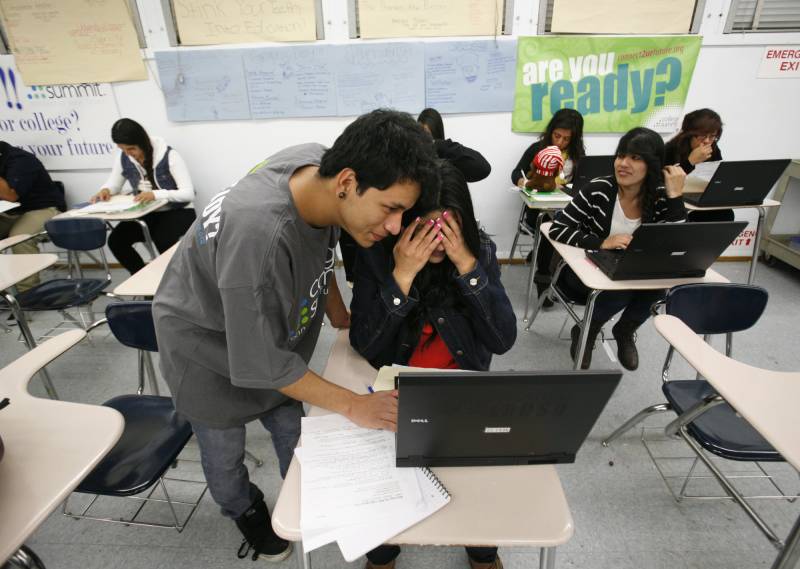

During the 2023–24 FAFSA cycle, the federal government launched a new version of the financial aid application in hopes of making the traditionally lengthy process more streamlined. However, students trying to use the new form faced delays, glitches and other technical problems that stopped many from being able to complete their application.

- Jump straight to: FAFSA deadlines to keep track of in 2025

After serious snags, new hopes for a new FAFSA

The problems with last year’s FAFSA especially impacted mixed-status individuals and created a major workload for school counselors across the state. And with those technical issues persisting — and a national ban of affirmative action unfolding in the background — fall semester enrollment declined by 5% after a similar decline in FAFSA completion rates, according to data from the National College Attainment Network (NCAN), a nonprofit that aims to increase postsecondary degree access.

However, the 2024-2025 cycle could be the year that the simplified FAFSA form proves to be a more efficient process for students — something that Daisy Gonzales, executive director of the California Student Aid Commission, is optimistic about.

Many of the FAFSA challenges from last year “have been fixed,” Gonzales said. “As students and families are completing that application, they should have a more seamless experience. There was a lot of testing nationally — and here in California — to make sure that in the beta phases, students could complete the application.”

These fixes include: FAFSA no longer requiring an identity verification process for those without a Social Security number; keeping a dossier of students who started an application for easier tracking by counselors; and increased call center staffing.

Another big improvement, Gonzales said, is that the FAFSA this year opened on Dec. 1, as opposed to Dec. 30 last year (although still later than the pre-2024 October opening date.)

Read on to learn more about what students and families should expect from this year’s FAFSA form — and the key FAFSA deadlines to know.

What if I am unsure about going to college this year?

Gonzales said that the biggest misconception people can make about the FAFSA is believing that they don’t qualify — whether that’s because their family is middle class, they’re thinking about joining the military or they’re going on a gap year.

Even if you’re uncertain about going to college at all, Gonzales said you should apply for FAFSA anyway. That way, you’ll have it completed in case they change your mind about your plans, and you’ll be sure you haven’t missed any deadlines.

“It’s never a bad idea to apply,” she said. And because “the aid here in California is very generous, very diverse,” many students — especially first-year college students — will qualify for some form of aid like grants, scholarships, subsidized loans or work-study. Among those programs is the Cal Grant — the state-specific aid program that California students can apply for through the FAFSA.

Other programs include:

- The Cal-HBCU program, which provides aid for California students transferring from California Community Colleges to a partnering Historically Black College.

- A grant for foster youth under 26 that funds five years of schooling

- Aid for undocumented students who also participate in community service

- Grants for students who are also parents

- Students planning to enter the teaching profession.

What tax documents do I need to complete the FAFSA??

First, a quick breakdown of tax vocabulary:

- A W-2 form is a tax document that an employer gives workers once a year, which shows how much the employer paid the worker that year.

- A 1040 form is a tax document, also known as a tax return, that a worker completes themselves, usually with the help of a tax expert. This document is sent to the IRS each year to confirm how much that worker got paid and how much they owe the government in taxes.

Most people in the U.S. receive a W-2 form and then complete a 1040 form themselves. FAFSA will ask parents to share information from last year’s documents. If the parents do not have this information, it could be for one of these reasons:

- The parent is a gig worker, such as driving for Uber or doing deliveries for GrubHub, they most likely did not get a W-2 form. Instead, the company they work for gave them a 1099 form. Ask for “their 1099” instead.

- The parents did not work last year and received unemployment benefits instead; they most likely did not get a W-2 form. In this case, the state government will have sent them a 1099-G form, which lists how much they received from unemployment benefits.

If a student’s parent has a W-2 form but does not have last year’s 1040 form, this probably means they haven’t filed their taxes yet. Colleges will still want to see their taxes, and applicants should ask their parents about scheduling an appointment with a tax preparer to catch up on this.

Many community organizations offer free tax filing services year-round. In the Bay Area, United Way can connect people to online and in-person tax help — and parents could potentially qualify to get cash back from the government when they file, based on their income and the size of the family.

If your family still needs to file their taxes, keep the schools you’re applying to updated about this.

What if I don’t have the documents I need to complete FAFSA?

In some cases, parents may be working at a job where they just won’t receive a W-2 or 1099 at all. Perhaps they work as a housecleaner, a nanny, a landscaper, a farmworker or another job where they haven’t signed a formal paper contract and are getting paid in cash. In these cases, Rosanna Ferro, chief of education at Oakland-based nonprofit College Track, told KQED earlier in 2024 that students can ask their parents, “How have you gotten paid in the past year or two?”

Ferro, whose organization works to help first-generation and low-income high school students from across the country graduate college, said that the point of this question is twofold: How often do their parents get paid, and how much do they get paid? The piece of information you need is what’s called “proof of income,” which can help you calculate how much your parents got paid per year.

For example, your father cleans houses and charges $100 per house. Based on the information he shares, you estimate that he can usually clean 10 houses a week. That approximates that he’s earning roughly $4,000 a month. Multiply that by 12 months, and you get an estimated $48,000 per year.

FAFSA applicants may have to get crafty to help their parents organize this information, Ferro said. “Whether it’s creating an Excel sheet, a Google folder or scanning something — taking a picture, a receipt or anything that shows income in any kind of way and storing it in a way that’s going to be accessible to you,” she said. This digital record can be especially helpful if the student applies for the FAFSA again next year.

While you’re doing this, you should remember to contact a financial aid officer from any of the schools you’re applying to, who can advise your family on how to best input this information into FAFSA. Schools may ask applicants to share additional documents, like a letter from an employer or potentially file a 1040 form with the data you’ve gathered.