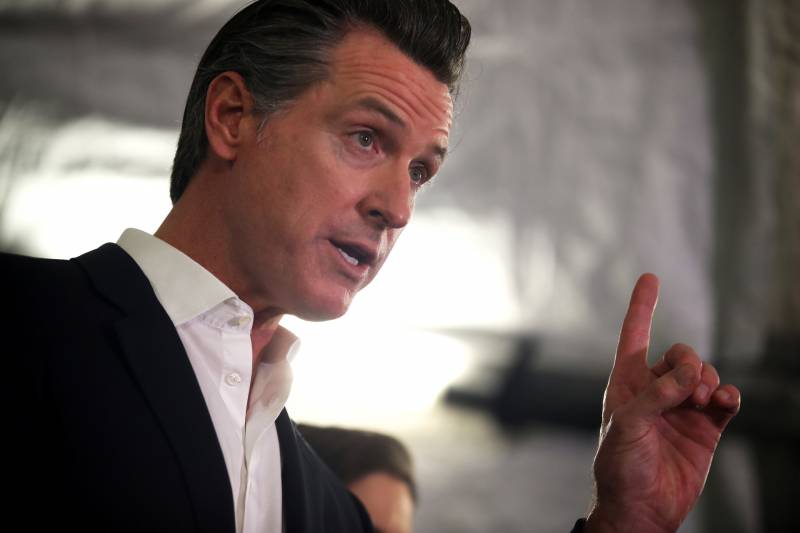

The California Legislative Analyst’s Office is recommending the state legislature reject Gov. Gavin Newsom’s proposal for a $1 billion green loan fund.

Reject Newsom's $1 Billion Green Loan Fund, California Legislature's Analyst Says

When Newsom released his state budget proposal in January, he announced the four-year revolving loan program, meant to help grow small- and medium-sized climate-friendly businesses.

The progam is intended to jumpstart businesses like electric vehicle charging stations, climate-friendly farming initiatives and other sustainability projects that have a hard time attracting private capital.

“As we grow, we must demand that the benefits of this growth be widely shared by workers and small businesses – not just those with access to huge amounts of capital,” Newsom said at the time.”

But in a report released Thursday by the LAO, a nonpartisan advisory agency for the state Legislature, analysts said the loan program would be problematic.

“It wasn’t clear exactly what projects would be eligible and whether those projects would actually be appropriate for a loan,” said Brian Weatherford, a senior fiscal and policy analyst for the LAO, in an interview.

The LAO said investing in businesses that could potentially provide the most benefit in terms of reducing emissions can be risky because many may not end up being feasible, can’t get regulatory approval or do not have a way to repay the loan.

The program is designed to be self-sustaining — as borrowers repay loans, the state can use the money to issue additional ones.

But Weatherford said the administration hasn’t identified projects that could both repay the loan and not be able to attract financing from the private sector or elsewhere.

The analysts also wrote in the report that the governor had not documented the demand for this kind of loan:

We acknowledge that appropriate projects could benefit from access to the low‑cost financing this fund would provide. However, the administration has not demonstrated the actual size of this need.”

Moreover, the analysts wrote, staff at the governmental entities that would authorize the loans don’t necessarily have “the deep technical knowledge or practical expertise that might be needed to accurately assess the risks of the eligible projects — especially those projects that conventional lenders, who have access to the necessary expertise, have refused to finance.”

While there is value in helping to finance these kind of businesses, the LAO said, it would be “inappropriate” given the risks.

The Newsom administration rejected the LAO’s reasoning.

“We disagree with the LAO’s assessment of the climate catalyst fund,” said Vicky Waters, Newsom’s press secretary, in an email. “California cannot wait to make major investments that deploy and scale technologies to meet our climate goals. We look forward to working with the Legislature on this issue.”

The report assessed all of Newsom’s major climate change proposals, including a $965 million cap-and-trade expenditure and a $4.75 billion climate bond.

On the climate bond, analysts said the governor’s proposal is one approach to designing the bond, “but the Legislature has other options.”

They recommend the state focus on its top climate priorities and consider how much to spend on immediate effects of climate change as compared to longer term impacts.