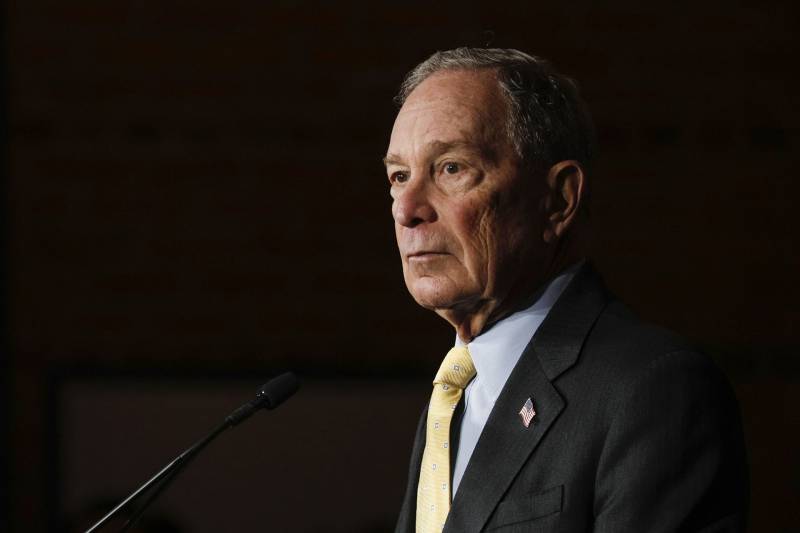

Stepping up his presence in California ahead of the March 3 presidential primary, former New York City Mayor Mike Bloomberg threw his weight behind a proposed ballot measure to remove tax protections on commercial property currently enjoyed under voter-approved Proposition 13, the landmark anti-tax measure approved by voters in 1978.

Under Proposition 13, county assessors treat all property — commercial and residential — the same when it comes to taxation. That would change under the proposed initiative, dubbed "Schools & Communities First" by its supporters.

Homeowners and some small businesses would not be affected by the measure, which includes a tax of 1% based on the purchase price and annual increases of up to 2%.

Supporters of the ballot measure, including powerful public employee unions such as the Service Employees International Union and the California Teachers Association, say they are in the final stages of collecting the signatures needed to place the measure before voters in November.

“Improving public schools and helping more students achieve at higher levels — as we did in New York City — requires dedicated teachers and faculty, and that costs money. But for too long, corporations in California have used property tax loopholes to avoid paying taxes that are essential to funding public schools, and California’s children have paid the price," Bloomberg said.