In the case of families with mixed status, where the head of household is undocumented and the spouse or children have a legal immigration status, “that is not an obstacle any more to receive the California EITC. If the taxpayer has a valid ITIN number and makes under $30,000, they should qualify,” López pointed out.

While ITIN holders qualify for the California EITC, they still are ineligible for the federal earned income tax credit.

López also highlighted how important it is to distinguish between government aid — like stimulus checks and rebates — and taxable benefits like unemployment.

"You have to report what you got from unemployment as part of your income," she said, while clarifying that stimulus checks – either from the state or federal government – are not taxable.

When Will I Get My California Stimulus Payment?

While California approved the Golden State Stimulus plan back in February, which includes a one-time payment of $600 for anyone who earned less than $30,000 last year, many residents are still waiting on their money after having filed their 2020 taxes.

The original timeline provided by the Department of Finance in March specified that eligible taxpayers who filed their 2020 taxes with direct deposit should expect to receive their rebate within a period of up to 45 days, while those without direct deposit may have to wait up to 60 days. That timeline is still accurate, according to the state.

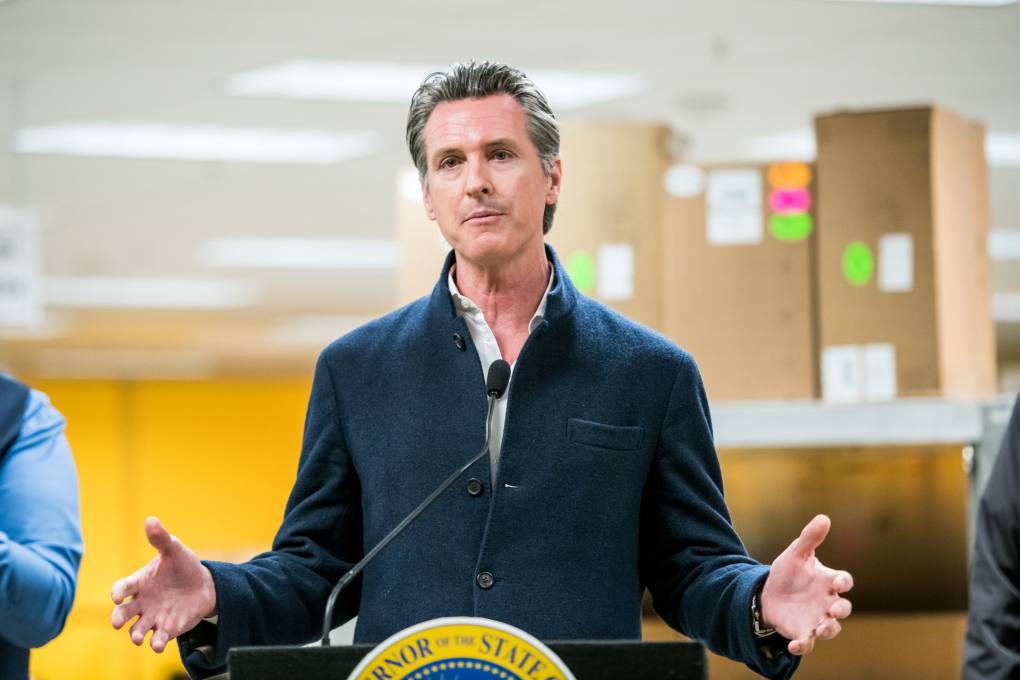

On top of that $600 stimulus check, Californians receiving Supplemental Security Income (SSI) qualify for additional $600 grants. Originally, the state intended to send this aid as a separate payment, but after Gov. Gavin Newsom signed SB 86 on April 16, the money will be added to each recipient’s monthly SSI check.

“With that now enacted, the grant payments should be received by individuals in the next six to eight weeks,” said H.D. Palmer, deputy director of external affairs for California’s Department of Finance, on April 16. According to that timeline, those receiving SSI should see the extra $600 added their benefits by mid-June.

Palmer also provided an update on the status of the state's additional $600 grant payments to families receiving CalWORKs, the state’s aid program for families with scarce resources. “All eligible CalWORKs families have received their Golden State Grant payment,” he said.

All CalWORKs Golden State grants were processed on March 27 and April 2, and the Department of Social Services sent out a voice notification to eligible families to confirm the status of the payments. According to the voice notification, families who receive their monthly CalWORKS aid by check will receive the additional $600 in the mail by the end of April.

If you receive CalWORKs benefits and have questions about the eligibility requirements for the CalWORKs Golden State grant, send an email to the Department of Social Services.

Applying for San Francisco’s Working Families Credit

While you don't need to do anything more than file your taxes to qualify for state rebates, applying for San Francisco’s Working Families Credit requires a little more work.

Taxpayers must have already filed their 2020 taxes before filling out a separate WFC application, explained Chandra Johnson, communications director of the San Francisco Human Services Agency (SFHSA), the office that’s managing the application process for this aid.

“We’re encouraging all families with low- to moderate-income to apply,” Johnson said. “While they are working on preparing their taxes either individually or working with San Francisco’s free tax assistance centers, we want to make sure that they know that this credit is available for them,” she added.

If you applied for and received this credit for your 2019 taxes, you'll automatically get a COVID-19 relief payment of $250 this year, no application required. But you'll have to apply again after filing your 2020 taxes to get this year's $250 credit (in addition to the automatic pandemic relief payment). SFHSA estimates about 4,000 families will be eligible for that $500 total combined credit.

“It’s something we haven’t done before. It’s something designed to be a local stimulus,” Johnson said. “We know families that received the credit last year are already some of the lowest-income working families here in the city. So in many instances, they’re continuing to face economic disparities that have worsened.”

To be considered for the WFC, a taxpayer must claim at least one dependent child. And while the income cap for legal residents to qualify is $56,844, the maximum is much lower for undocumented workers — $30,000 — as it’s based on California EITC parameters. This is the first year the WFC is being made available to taxpayers who file with an ITIN, such as undocumented workers.

Get started on your WFC application (available in six languages) and find organizations that can help you complete it, either virtually or in person, by going here.

How to Request an ITIN

If you do not have a Social Security number, you'll need to file your taxes with an Individual Taxpayer Identification Number. The only agency that can grant an ITIN is the IRS. But an organization or person trained and authorized by the IRS – a certifying acceptance agent (CAA) – can help you request an ITIN.

When you apply for an ITIN, whether by yourself or with the help of a CAA, you’ll need to print, fill out and mail a W-7 form, which requires supporting documentation to verify your identity and foreign status.