This story contains a correction.

Skip straight to:

The 2021 IRS deadline for filing your taxes has been pushed to May 17 to give people more time to get organized in the wake of the COVID-19 pandemic.

Even with this extra time, your situation is likely to be even more complicated if you’ve been unemployed during the course of the pandemic — since you have to pay taxes on federal unemployment if you earned above a certain amount in benefits.

With the new IRS tax filing deadline now less than a month away, here's what you need to know about filing your taxes if you've claimed unemployment benefits this year — and where you can find free or low-cost tax help, even after many such support services closed up shop on the original IRS deadline of April 15.

I Received Unemployment Benefits in 2020. How Are They Taxed?

Unlike many other states, Californians do not have to pay state income tax on unemployment benefits.

Unemployment benefits are subject to federal taxes, but the American Rescue Plan created new thresholds for what’s taxable in this case.

If your modified adjusted gross income (AGI) is less than $150,000, for singles or married people filing separately, you don’t have to pay taxes on the first $10,200 of 2020 unemployment benefits you earned. For married people filing jointly, if each spouse received unemployment, this exemption applies to the first $10,200 worth of benefits for both individuals. If your modified AGI is $150,000 or more, this exemption does not apply to you. And the threshold stays the same for all statuses — it will not double to $300, 000 if you are married and filing a joint return, for example.

If you file a Form 1040-NR (or U.S. Non Resident Alien Income Tax Return), the IRS says your spouse isn’t eligible for the tax break on the first $10,200 worth of benefits.

According to the Employment Development Department (EDD), Pandemic Additional Compensation — that extra $600 federal benefit bump people got from March until late July, and the extra $300 federal benefit bump people started getting in late December — is taxable and must be included in your gross income. However, don’t confuse this money with one-off stimulus checks from the U.S. government (most recently $1,400), which are not taxable. Read more about pandemic federal benefits if you're claiming unemployment in California.

What Kind of Unemployment Documentation Do I Need For Filing My Taxes?

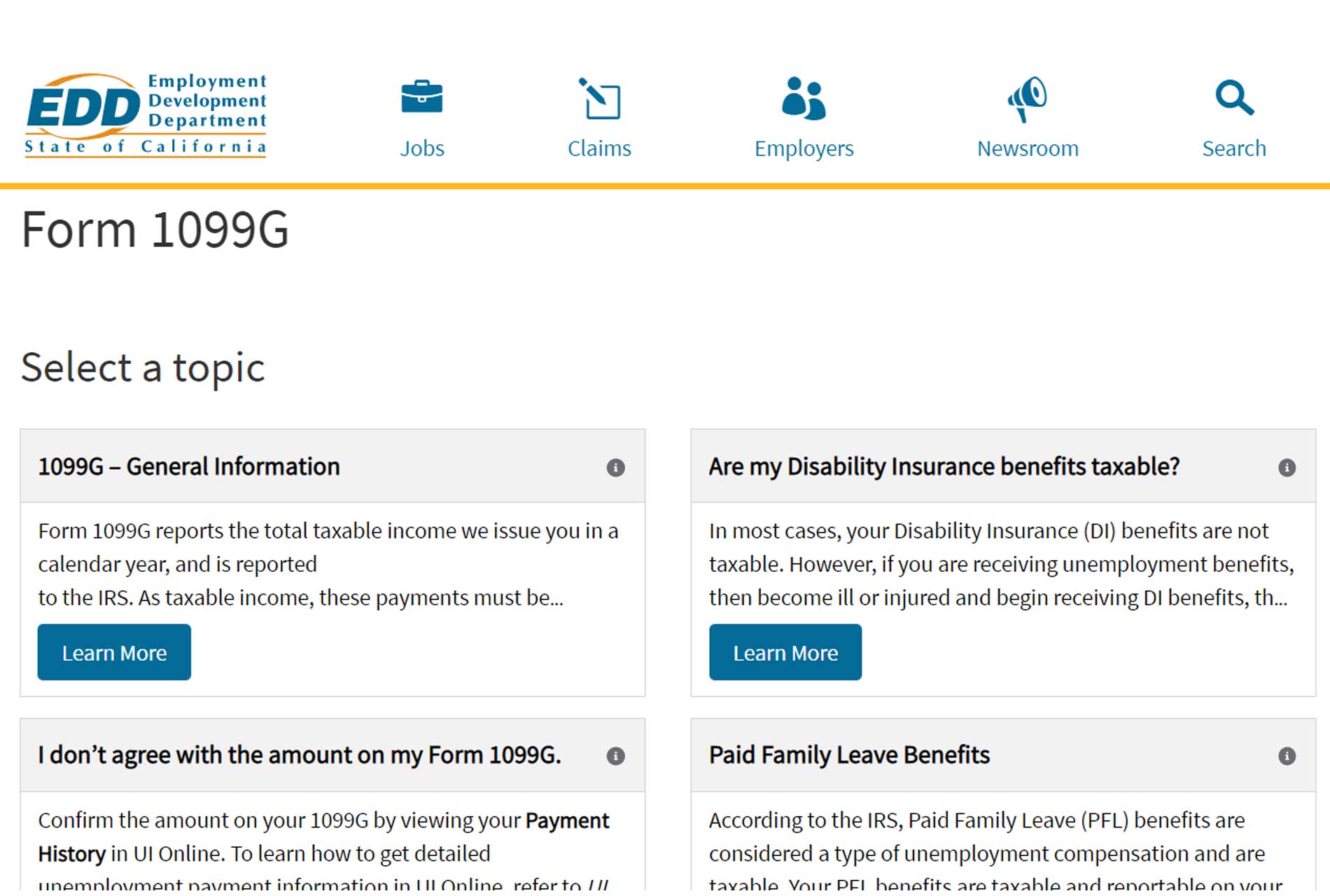

If you received unemployment benefits in 2020, EDD should have already sent you your 1099G form, which is a record of the total taxable income EDD has issued to you in a calendar year.

If you haven’t gotten this form for some reason, you can print one or request a paper copy through your UI Online account on EDD’s website.