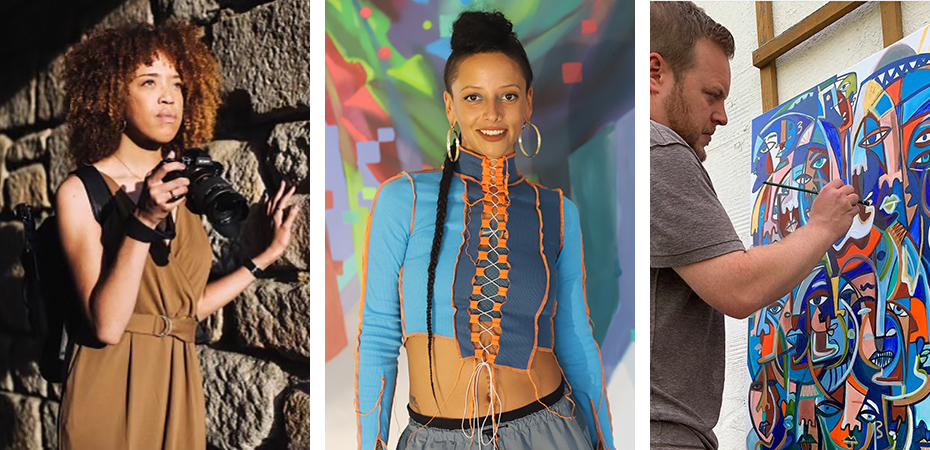

Alexandria LaRue became a sex worker in 2012, posting photos and videos on Backpage, a now-defunct classified advertising website that gained notoriety for its adult-themed content.

Almost immediately after LaRue — who uses the pronoun “they” — started doing this work, Bank of America closed their account and seized the more than $2,000 that was in it. Bank of America and other large banks are allowed to freeze deposits or entire accounts if they believe fraud or suspicious activity is occurring.

“It feels like nothing is a safe space or a safe place, especially when it comes to finances,” LaRue, who posted pornographic videos online, said. “Even though the work I do is 1,000 percent legal, it doesn’t mean they won’t shut down my account or they won’t take my money away.”

Backpage started processing payments in cryptocurrency soon after Visa and Mastercard cut off ties with the website in 2015 as allegations grew that it was complicit in sex trafficking. Finally in 2018, the Department of Justice seized the website and shut it down for “facilitating prostitution.”

The limits of traditional banking

A few days after the end of Backpage, Congress passed a series of bills into law aimed at curbing sex trafficking.

The laws, known as the Allow States and Victims To Fight Online Sex Trafficking Act (FOSTA) and the Stop Enabling Sex Traffickers Act (SESTA), attempted to shut down websites that facilitated sex trafficking online by increasing liability for third-party platforms — like Pornhub, RedTube and others — if they hosted content which played any role in facilitating sex trafficking or other illegal activities.