On a single day, July 16, the state received more than $800 million than expected in corporate tax payments, “by far its single biggest day of collections” for a July going back at least four decades, state deputy legislative analyst Brian Uhler told CalMatters. (He excluded 2020 because the pandemic delayed tax deadlines.)

This July, the Finance Department said it collected about $1.4 billion in corporate taxes, nearly three times the agency’s forecast of $500 million. In June, corporate taxes were $263 million above forecast, and in May, $752 million over. “The July average was likely due to large payments by a small number of companies and may not necessarily be indicative of overall corporation tax revenue trends,” the department said in its monthly bulletin (PDF).

Tax records are confidential, and representatives from both the Finance Department and the Franchise Tax Board stressed that nobody at the state is allowed to discuss details or information from specific tax returns or payments.

But the July influx in corporate tax payments was likely related to changes in state tax rules adopted in June, according to state and accounting experts who spoke with CalMatters. The tax changes, intended to help close the deficit, include a suspension of a deduction businesses can claim to offset profit, called the net operating loss deduction, as well as a $5 million limit on how much businesses can claim for research and development and other tax credits.

It’s possible that companies expecting to have outsized profit realized they owed more in taxes and needed to make large estimated tax payments immediately after the changes were enacted, accounting experts said. Corporations that expect to owe taxes are required to make quarterly estimated tax payments and can incur penalties if the payments are late. State analysts believe the new taxes could disproportionately come from “businesses in riskier or more innovative industries — such as the technology, motion picture, and transportation sectors,” as they put it when the changes were proposed.

In California, a red-hot tech company fits the bill of outsized profits and risky innovation: Nvidia, which is raking in record amounts of money because of the artificial intelligence boom.

As other companies scramble to get ahead in the AI race, they are buying Nvidia’s chips and propelling the company to new heights. On Aug. 28, Nvidia reported second-quarter net income of $16.6 billion, which was more than double its profit from the same period last year — and about the same amount spent by all state and federal campaigns in the last election.

Nvidia’s annual financial report from 2023 shows that it had $1.5 billion in unused California tax credits for research and development. Between the cap on that tax credit and the suspension of the loss deduction the company could have claimed against its rising profit, Nvidia probably realized it would have a larger tax bill, accounting experts told CalMatters. That’s why it may have been the company or one of the companies that made the sizable estimated tax payment to the state.

Nvidia’s most recent quarterly filing provides additional clues: The company paid a total of $7.21 billion in income taxes in the second quarter, a whopping 31-fold increase from the $227 million it paid in taxes in the same period last year. For the first six months of its 2024 fiscal year, Nvidia paid $7.45 billion in income taxes, compared with $328 million in the first half of 2023. Those totals included federal and state taxes. California has a flat corporate tax rate of 8.84% of a company’s net income, while the federal tax rate is a flat 21%.

If Nvidia was largely responsible for the July tax windfall, due to an estimated tax payment, the company likely expects a lot of taxable income this year, said Francine McKenna, an independent financial journalist who writes the Dig newsletter and has taught financial accounting at the University of Pennsylvania’s Wharton business school. McKenna said if that’s the case, and because there’s a limit on how much the company can claim in terms of other tax credits, Nvidia will likely make another sizable estimated tax payment in the third quarter.

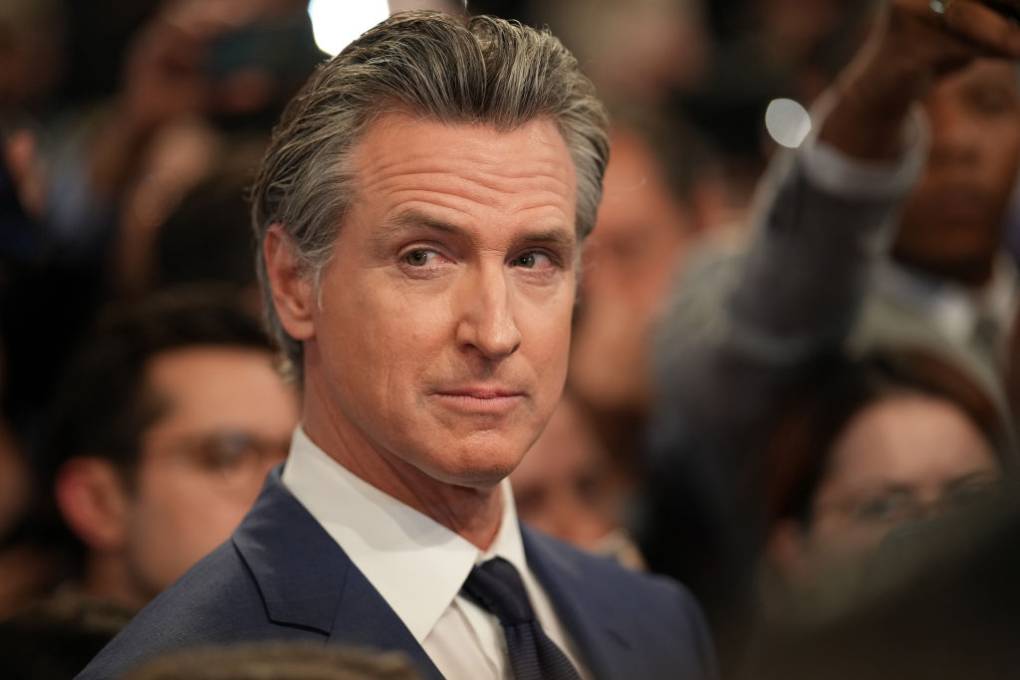

An Nvidia spokesperson would not comment. Neither would a spokesperson for Gov. Gavin Newsom.

“I’d expect payments from other companies as well, potentially,” said Brett Whitaker, a former tax executive at Ernst & Young, Nike and Mattel who now teaches corporate tax accounting at Indiana University. “They depend on these credits often to avoid paying tax, so suspending them could drive tax for many.”

Whitaker said most companies try to take advantage of R&D tax credits: “Big Four (accounting) firms have entire teams dedicated solely to this effort.” But he added that the credits are especially commonly used by tech companies and others whose businesses rely on innovation.

It’s hard to tell exactly when those other estimated tax payments will come and how significant they will be, Finance Department spokesperson H.D. Palmer said.

Estimated tax payments are due in April, June, September and January, but those payments are not always made on time so can come in at any time, according to the Franchise Tax Board.

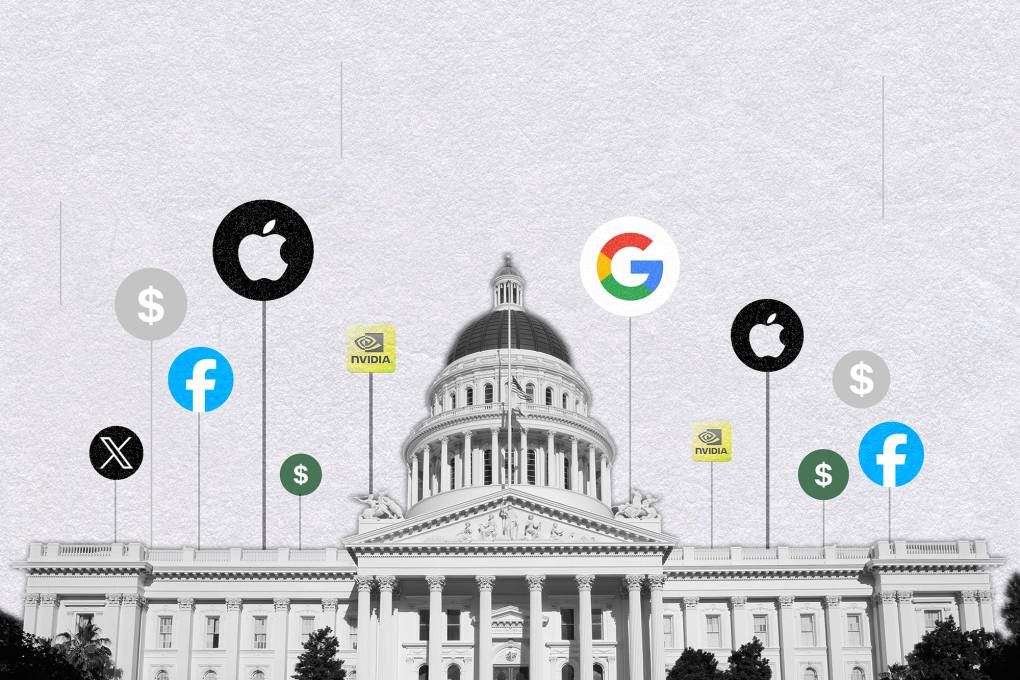

A CalMatters examination of Silicon Valley’s biggest tech companies’ financial filings with the federal Securities and Exchange Commission suggests that some of them may also be affected by the tax changes. That means the companies could make estimated tax payments that could be similar in size to the ones the state received in July.

Apple, Google parent Alphabet and Facebook parent Meta are among the companies whose financial filings show they have past losses, which they could normally deduct, and/or unused research and development tax credits in the state.

As of last Dec. 31, Alphabet had $18.6 billion in old losses in California. The tech giant also had $6.3 billion in research and development credits. As of the same date, Meta had $2.78 billion in past losses in the state, as well as $4.08 billion in unspecified state tax credits from prior periods. And as of Sept. 30, 2023, Apple had $3 billion in research and development credits. All these companies are highly profitable, and whatever deductions and credits they were expecting to use are now either on hold or limited.

According to the analysis of the budget bill that included the tax changes, California’s deduction suspension and tax-credit limits could increase state revenue by $5.95 billion this fiscal year, $5.5 billion the following fiscal year and $3.4 billion the year after that.